Florida, the Sunshine State, is known for its beautiful beaches, vibrant culture, and unfortunately, skyrocketing car insurance rates. If you drive in Florida, you’ve likely felt the sting of ever-increasing premiums. But how much have things really changed? In this article Cheap Insurance takes a deep dive into the dramatic rise of Florida car insurance rates since the 1980s.

Key Takeaways:

- Florida car insurance rates have skyrocketed since the 1980s due to rising medical costs, increased lawsuits, and more frequent natural disasters.

- Florida drivers pay significantly more than the national average for car insurance.

- Strategies such as comparing car insurance quotes, maintaining a clean driving record, and increasing your deductible can help you find the cheapest car insurance.

- Florida residents can advocate for change by contacting their state representatives, supporting consumer protection initiatives, and choosing responsible insurance companies.

- The future of car insurance rates in Florida depends on various factors, but staying informed and advocating for change can empower you to find affordable auto insurance coverage.

National Insurance Costs Since 1980

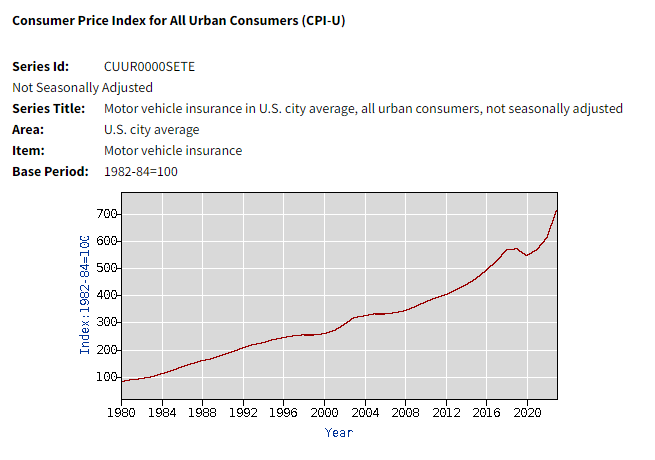

In our May 2020 reporting on How auto insurance rates have changed over the past decades we observed the following national car insurance premium trends based on U.S. Bureau of Labor Statistics data:

1980s

– Average monthly insurance premium: $119

– Premium increase from start of decade: $85 (103%)

1990s

– Average monthly insurance premium: $225

– Premium increase from start of decade: $76 (43%)

2000s

– Average monthly insurance premium: $315

– Premium increase from start of decade: $100 (39%)

2010s

– Average monthly insurance premium: $464

– Premium increase from start of decade: $196 (52%)

2020s

– Average monthly insurance premium: $564

– Premium increase from start of decade: $38 (7%)

How Expensive Was Florida Car Insurance in the 1980s?

Compared to today’s costs, car insurance in Florida during the 1980s was significantly more affordable. While exact figures can vary depending on factors like age, driving record, and vehicle type, anecdotal evidence and historical data suggest drivers paid several hundred dollars less annually for minimum liability coverage than they do today.

Here’s an example for some perspective: According to U.S. Bureau of Labor Statistics data, the monthly national average cost of auto insurance in 1989 was $119, which was an $85 increase from 1980, a 103% increase in the decade.

What Factors Influenced Car Insurance Costs Over The Decades?

Several factors influenced car insurance costs in the 1980s:

- Lower Medical Costs: Medical care costs significantly impact car insurance premiums. In the 1980s, medical treatments and procedures were generally less expensive than they are today. This translated to lower payouts for insurance companies in the event of an accident.

- Fewer Lawsuits: The legal landscape in the 1980s saw fewer personal injury lawsuits related to car accidents compared to today. This meant lower legal costs for insurance companies, reflected in lower premiums.

- Safer Cars: While safety features have continued to improve, cars in the 1980s were generally less safe than modern vehicles. However, with a lower population density and potentially less traffic congestion, the overall risk of accidents might have been slightly lower in some areas.

These factors combined created a more favorable environment for lower car insurance rates in Florida during the 1980s.

Understanding the Spike:

Since the 1980s, several factors have dramatically increased Florida car insurance rates

Has Florida’s Weather Played a Role in Increasing Insurance Costs? (Hurricanes, etc.)

Florida’s geographical location makes it highly susceptible to natural disasters like hurricanes, events such as flooding, and even hailstorms. The frequency and intensity of these storms have increased in recent decades, leading to significant property damage and car insurance claims.

According to the National Oceanic and Atmospheric Administration (NOAA), 23% of all billion-dollar weather disasters in the US since 1980 (adjusted for inflation) have occurred in Florida. The rising number of costly natural disasters translates to higher premiums for Florida drivers, as insurance companies compensate for potential losses.

Has Driving Behavior in Florida Changed Over Time?

Florida’s population has exploded since the 1980s. This population growth translates to more cars on the road, leading to increased traffic congestion, especially in major cities. Studies have shown a correlation between increased traffic congestion and higher accident rates.

Furthermore, factors like distracted driving due to cellphone use and other in-vehicle technology, as well as a higher tolerance for speeding may contribute to a rise in accidents, impacting insurance costs.

How Have Legal Climate and Lawsuits Impacted Florida’s Car Insurance Rates?

The legal landscape in Florida has become more litigious since the 1980s. This means an increase in personal injury lawsuits related to car accidents. Florida is known for having one of the highest rates of personal injury protection (PIP) claims in the nation.

PIP auto insurance coverage helps cover medical expenses for those injured in car accidents, regardless of fault. However, the abundance of lawsuits and potentially inflated medical claims associated with PIP can drive up insurance costs for all Florida drivers.

These factors – rising medical costs, a more litigious culture, and a higher frequency of natural disasters – have created a “perfect storm” driving up car insurance rates in Florida.

How Do Today’s Florida Car Insurance Rates Compare to the National Average?

In reporting from Bankrate, the average annual auto insurance premium in Florida is $3,945, which is about 5.69% of the average Floridian’s income. This is $1,402 higher than the national average, putting Florida at number 49 – second highest out of the 50 states

The National Trend

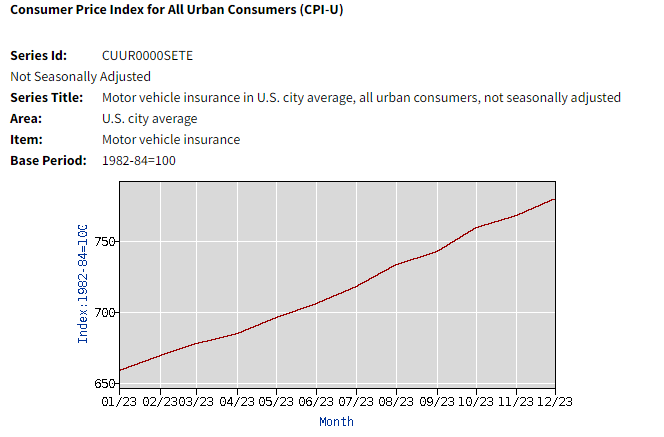

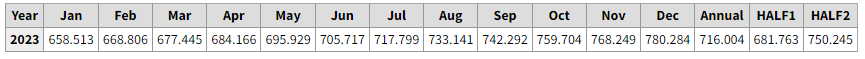

In 2023 the U.S. Bureau of Labor Statistics reported that nationally, the average annual auto premium increased from $658.51 in January to $780.28 in December. The average annual auto insurance premium overall for all of 2023 was $716.00, with the first half of 2023 coming in at $681.76, and the second half was reported at $750.24.

What Are Some Strategies Florida Drivers Can Use to Save on Car Insurance Today?

While Florida auto insurance rates are high, there are still ways to save:

- Compare Car Insurance Quotes: Don’t settle for the first quote you receive. Utilize online comparison tools and contact multiple insurance companies to compare quotes to find the cheapest auto insurance with the best coverage options.

- Maintain a Clean Driving Record: Traffic violations including speeding tickets, and accidents significantly increase insurance premiums. Too many infractions and accidents could result in the need for an SR-22 requirement. Practice safe driving habits and avoid getting tickets to maintain a clean record.

- Increase Your Deductible: A deductible is the amount you pay out-of-pocket before your insurance kicks in. Choosing a higher deductible can lower your car insurance premiums, but remember, you’ll be responsible for a larger upfront cost if you need to file a claim.

- Take Advantage of Discounts: Many auto insurance companies offer discounts for things like good student discounts, low-mileage discounts, bundling car and home insurance, completing defensive driving courses, and opting for paperless billing.

- Consider Usage-Based Insurance: Usage-based insurance programs track your driving habits (telematics) and reward safe drivers with lower premiums.

What Can Florida Residents Do to Advocate for Affordable Car Insurance Rates?

Concerned Florida residents have a few options to advocate for more affordable car insurance:

- Contact Your State Representative: Voice your concerns about rising car insurance rates to your state representative. They may support legislation aimed at addressing the issue.

- Support Consumer Protection Initiatives: Stay informed about and support initiatives promoting consumer protection in the car insurance industry. This might include measures to reduce fraudulent claims or limit frivolous lawsuits.

By staying informed, comparing auto insurance quotes, and advocating for change, Florida drivers can navigate the current insurance landscape and potentially find more affordable car insurance options.

The future of car insurance rates in Florida remains uncertain. While factors like technological advancements in accident prevention could lead to lower costs, others like climate change and a growing population might continue to exert upward pressure.

Staying informed about these trends and advocating for consumer-friendly policies can help Florida drivers navigate the ever-changing world of car insurance.