Colorado drivers have felt the sting of rising car insurance costs for decades. But just how much have rates changed since the 1980s, and what factors are driving this seemingly never-ending climb? In this article Cheap Insurance explores the reasons behind price increases over the decades for car insurance in Colorado and offers tips to navigate the current landscape.

Key Takeaways:

- Colorado car insurance rates have likely increased significantly since the 1980s, mirroring a national trend.

- Factors like rising accident rates, medical costs, and car repair expenses contribute to higher premiums.

- Colorado drivers can manage costs by comparing rates, maintaining a clean record, and adjusting coverage levels.

- Future trends like autonomous vehicles and safety technology may influence car insurance prices.

- Staying informed about Colorado’s insurance landscape empowers you to make informed car insurance decisions.

National Insurance Costs Since 1980

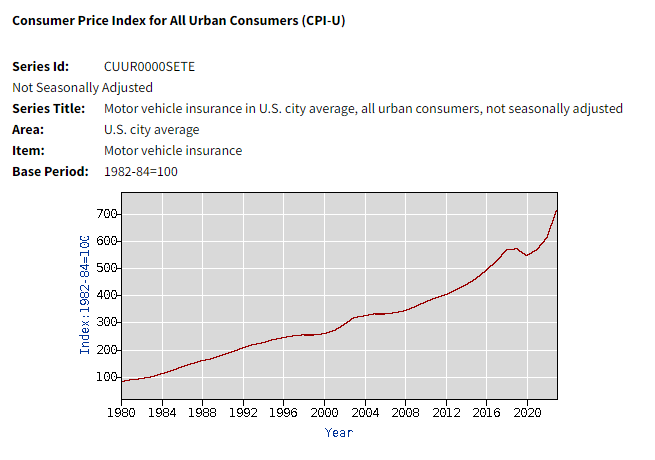

In our May 2020 reporting on How auto insurance rates have changed over the past decades we observed the following national car insurance premium trends based on U.S. Bureau of Labor Statistics data:

1980s

– Average monthly insurance premium: $119

– Premium increase from start of decade: $85 (103%)

1990s

– Average monthly insurance premium: $225

– Premium increase from start of decade: $76 (43%)

2000s

– Average monthly insurance premium: $315

– Premium increase from start of decade: $100 (39%)

2010s

– Average monthly insurance premium: $464

– Premium increase from start of decade: $196 (52%)

2020s

– Average monthly insurance premium: $564

– Premium increase from start of decade: $38 (7%)

What Factors Have Driven Up Car Insurance Costs in Colorado?

Several key factors contribute to the rising cost of car insurance in Colorado:

- Increased Accident Rates: Colorado Department of Transportation (CDOT) data shows a rise in the number of traffic accidents over the past few decades. This translates to more insurance claims, putting pressure on insurers to raise premiums.

- Rising Medical Costs: Medical expenses associated with car accidents have skyrocketed in recent years. The cost of medical treatments, hospital stays, and rehabilitation are factored into insurance payouts, leading to higher premiums.

- More Expensive Cars & Repair Costs: Modern vehicles are packed with advanced safety features and complex technology. While this improves safety, it also drives up repair costs after an accident. Replacing these components can be expensive, leading insurers to adjust premiums accordingly.

- Distracted Driving: The rise of smartphones and in-car technology like touchscreen infotainment systems has contributed to a surge in distracted driving. This reckless behavior increases the likelihood of accidents, prompting insurers to raise rates to offset the risk.

- Legal Environment and Lawsuits: Colorado’s legal environment plays a role as well. The state has a “no-fault” insurance system, where your own car insurance company typically covers your initial medical expenses regardless of who caused the accident. While this aims to streamline claim processing, it can also lead to more lawsuits, further impacting insurance costs.

How Affordable Was Car Insurance in Colorado During the 1980s?

Compared to today’s costs, car insurance in Colorado during the 1980s was significantly more affordable. Anecdotal evidence and historical data suggest drivers paid several hundred dollars less annually for minimum liability auto insurance coverage than they do today.

Here’s a perspective: According to U.S. Bureau of Labor Statistics data, the monthly national average cost of auto insurance at the end of the 1989 was $119 – which was $85 higher than the first year of the decade, 1980.

Was There a Specific Event in the 1980s that Impacted Colorado Car Insurance?

The 1980s may not have witnessed a single, defining event that drastically altered the Colorado auto insurance landscape. However, the decade saw a confluence of factors that likely contributed to the initial rise in premiums.

- Surge in Traffic: Colorado’s population has been steadily growing for decades. This translates to more cars on the road, increasing congestion and the risk of accidents.

- Changes in Auto Safety Regulations: Federal regulations mandating airbags, seatbelts, and other safety features in newer vehicles began to take hold in the 1980s. While these advancements aim to protect lives, the cost of repairing these complex features after an accident is reflected in insurance premiums.

Are There Ways to Reduce Car Insurance Costs in Colorado Today?

While the overall trend might seem bleak, there are ways for Colorado drivers to manage their car insurance costs:

- Compare Car Insurance Quotes: Don’t settle for your current insurer’s renewal offer. Get auto insurance quotes from multiple companies to find the best rate for your driving record and vehicle.

- Maintain a Clean Driving Record: Traffic violations including speeding tickets, and accidents significantly increase premiums. Too many infractions and accidents could result in the need for an SR-22 requirement. Practice safe driving habits and avoid distractions.

- Increase Your Deductible: A higher deductible lowers your auto insurance premium. However, choose a deductible you can comfortably afford in case of an accident.

- Consider Usage-Based Insurance: Telematics programs offered by some auto insurance companies track driving behavior and reward safe drivers with discounts.

- Bundle Your Insurance: Bundling your auto insurance with your homeowners insurance or renters insurance can often lead to a discount.

- Review Your Coverage: Regularly assess your coverage needs. If your car is older or has low value, consider dropping comprehensive coverage for a cheaper car insurance policy.

How Do Current Colorado Car Insurance Rates Compare to the National Average?

Reporting from Bankrate indicates that the average annual auto insurance premium in Colorado is $2,902. This is $339 higher than the national average, putting Colorado at number 30 on the list of states with the highest car insurance costs.

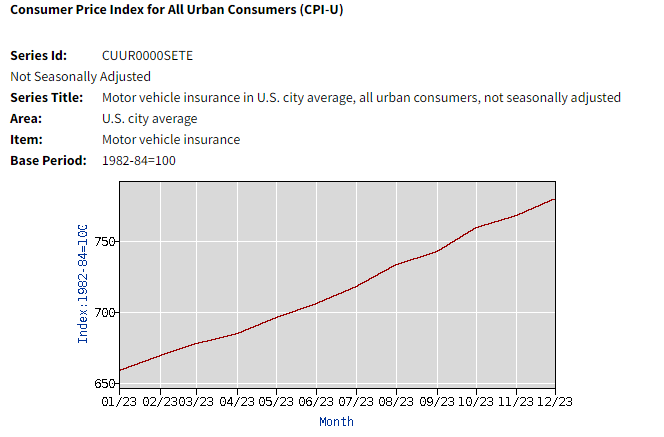

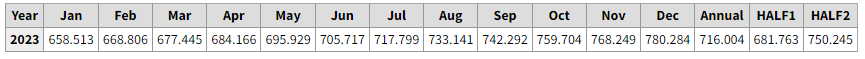

The Recent National Trend

In 2023 the U.S. Bureau of Labor Statistics reported that the average annual auto premium increased from $658.51 in January2023 to $780.28 in December 2023. The average annual auto insurance premium for all of 2023 was $716.00, with the first half of 2023 hitting $681.76, and the second half coming in at $750.24.

What Does the Future Hold for Car Insurance Costs in Colorado?

Autonomous Vehicles: The widespread adoption of self-driving cars has the potential to significantly reduce accidents, potentially leading to lower car insurance rates in the long run. However, the timeline for widespread adoption remains uncertain.

- Technology and Accident Prevention: Advancements in safety features like automatic emergency braking and lane departure warnings could contribute to fewer accidents, impacting premiums positively.

- Climate Change and Extreme Weather Events: The increasing frequency of severe weather events like hailstorms can cause widespread damage to vehicles, leading to more claims and potentially impacting premiums.

- Regulation and Legal Reforms: Changes in Colorado’s legal system or insurance regulations could affect car insurance costs. For instance, reforms aimed at reducing frivolous lawsuits might lead to lower premiums.

Colorado drivers have grappled with rising car insurance costs for decades. Understanding the factors behind this trend and the available strategies to manage premiums can empower you to make informed decisions. By comparing rates, maintaining a clean driving record, and tailoring your coverage, you can navigate the Colorado auto insurance landscape and find an affordable auto insurance plan that meets your needs.