Hitting the open road in Arizona has always been a part of the state’s allure. However, Arizona drivers today face a reality far different from their counterparts cruising the highways in the 1980s. A significant change? The ever-rising cost of car insurance. In this article Cheap Insurance explores the dramatic rise in car insurance rates in Arizona, delving into the reasons behind it and offering tips for navigating the current landscape.

Key Takeaways:

- Arizona car insurance rates have likely increased significantly since the 1980s, mirroring a national trend.

- Factors like rising traffic congestion, medical costs, and car repair expenses contribute to higher premiums in Arizona.

- Compared to some states, Arizona’s “fault” system and specific risk factors like theft rates can impact insurance costs.

- Arizona drivers can manage costs by comparing rates, maintaining a clean record, and adjusting coverage levels.

- Staying informed about future trends like autonomous vehicles and safety technology might influence car insurance prices in Arizona.

National Insurance Costs Since 1980

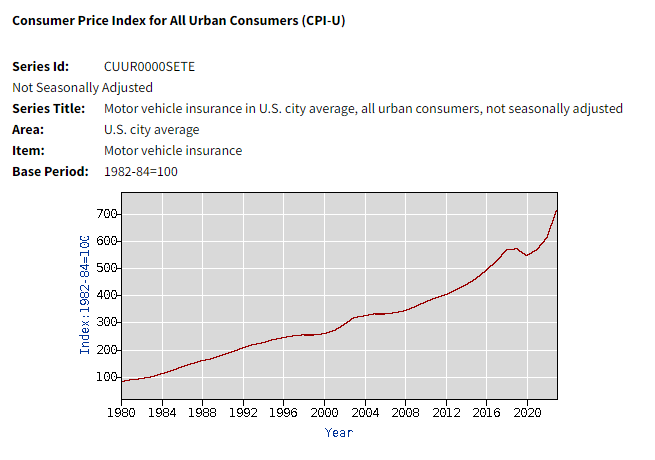

In our May 2020 reporting on How auto insurance rates have changed over the past decades we observed the following national car insurance premium trends based on U.S. Bureau of Labor Statistics data:

1980s

– Average monthly insurance premium: $119

– Premium increase from start of decade: $85 (103%)

1990s

– Average monthly insurance premium: $225

– Premium increase from start of decade: $76 (43%)

2000s

– Average monthly insurance premium: $315

– Premium increase from start of decade: $100 (39%)

2010s

– Average monthly insurance premium: $464

– Premium increase from start of decade: $196 (52%)

2020s

– Average monthly insurance premium: $564

– Premium increase from start of decade: $38 (7%)

How Much Have Car Insurance Rates Changed in Arizona Since the 1980s?

According to Bankrate, the average annual car insurance premium in Arizona is $2,535. This is $8 less than the national average, placing Arizona at the number 33 spot on the list of states with the highest auto insurance costs.

To put this into perspective: According to U.S. Bureau of Labor Statistics data, the monthly national average cost of auto insurance at the end of the 1980s was $119, which is 103% higher that it was at the start of the decade.

What Factors Have Driven Up Car Insurance Costs in Arizona?

Several key factors contribute to the rising cost of auto insurance in Arizona:

- Increased Traffic Congestion: Arizona’s population has boomed, leading to more cars on the road, especially in major cities like Phoenix and Tucson. This translates to higher accident rates, a major factor influencing insurance premiums.

- Rising Medical Costs: Medical expenses associated with car accidents have skyrocketed. The cost of treatments, hospital stays, and rehabilitation are factored into insurance payouts, leading to higher rates in Arizona.

- More Expensive Cars & Repair Costs: Modern vehicles are packed with advanced safety features and complex technology. While this improves safety, it also drives up repair costs after an accident. Replacing these components can be expensive, leading insurers to adjust premiums accordingly.

- Distracted Driving: The proliferation of smartphones and in-car technology has contributed to a surge in distracted driving in Arizona. This reckless behavior increases the likelihood of accidents, prompting insurers to raise rates to offset the risk.

- Theft Rates: While Arizona’s overall theft rates might fluctuate, certain areas within the state experience higher rates of car theft. This can influence insurance premiums for those areas. You can find Arizona’s theft rate statistics through the Arizona Department of Public Safety.

- Legal Environment and Lawsuits: Arizona has a “fault” insurance system, where the at-fault driver’s insurance company typically covers damages. This system can lead to more lawsuits, as drivers and their insurers fight over who is responsible, impacting insurance costs.

Were There Specific Events in the 1980s That Impacted Arizona Car Insurance?

The 1980s may not have witnessed a single, defining event that drastically altered Arizona’s car insurance landscape. However, the decade saw a confluence of factors that likely contributed to the initial rise in premiums.

- Surge in Population and Traffic: Arizona’s population growth began accelerating in the 1980s. This translates to more cars on the road, increasing congestion and the risk of accidents.

- Changes in Auto Safety Regulations: Federal regulations mandating airbags, seatbelts, and other safety features in newer vehicles became more prominent in the 1980s. While these advancements aim to protect lives, the cost of repairing these complex features after an accident is reflected in insurance premiums.

While no single event defines the shift, these developments in the 1980s likely laid the groundwork for the ongoing rise in Arizona’s car insurance costs.

How Does Arizona’s Car Insurance System Compare to Other States?

While Arizona drivers face rising costs, it’s important to understand the national context. Here’s how Arizona’s car insurance system stacks up against other states, and how it impacts the ability to find affordable car insurance in Arizona:

- Fault vs. No-Fault: Unlike some states with “no-fault” systems, Arizona has a “fault” system. This means the at fault driver’s insurance is responsible for damages, which can lead to more lawsuits and potentially higher premiums compared to no-fault states.

- National Trends: The national trend of rising car insurance costs also applies to Arizona. However, the exact increase might vary depending on factors like a state’s specific regulations, accident rates, and medical costs. Resources from the National Association of Insurance Commissioners (NAIC) can provide a broader perspective on national car insurance trends.

- State-Specific Factors: While national trends influence Arizona, factors specific to the state also play a role. Arizona’s growing population, traffic congestion, and theft rates in certain areas contribute to higher premiums compared to states with different demographics or risk profiles.

While Arizona might not be an outlier in terms of rising car insurance costs, the state’s specific factors and fault-based system contribute to its current landscape.

The National Trend

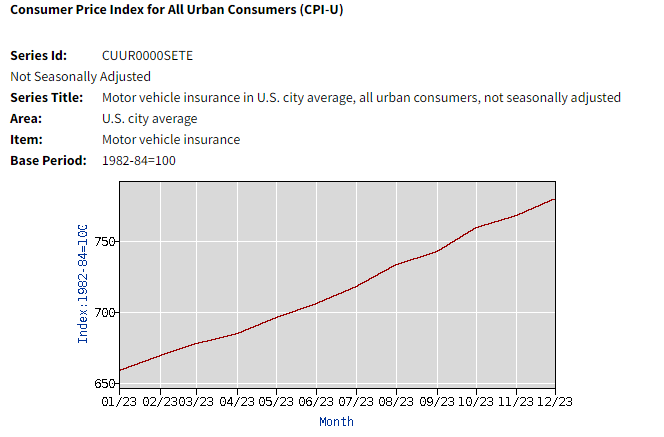

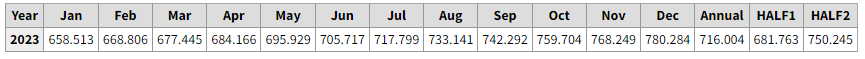

In 2023 the U.S. Bureau of Labor Statistics reported that the average annual auto insurance premium increased from $658.51 in January to $780.28 in December. The average annual auto insurance premium for all of 2023 was $716.00, with the first half of 2023 coming in at $681.76, and the second half at $750.24.

Are There Ways to Reduce Car Insurance Costs in Arizona Today?

Even with rising costs, there are ways for Arizona drivers to manage their car insurance expenses:

- Maintain a Clean Driving Record: Traffic violations including speeding tickets, and accidents significantly increase premiums. Too many infractions and accidents could result in the need for an SR-22 requirement. Practice safe driving habits and avoid distractions.

- Increase Your Deductible: A higher deductible lowers your car insurance premium. However, choose a deductible you can comfortably afford in case of an accident.

- Consider Usage-Based Insurance: Telematics programs offered by some insurers track driving behavior and reward safe drivers with discounts.

- Bundle Your Insurance: Bundling your auto insurance with your homeowners insurance or renters insurance can often lead to a discount.

- Review Your Coverage: Regularly assess your coverage needs. If your car is older or has low value, consider dropping comprehensive car insurance coverage.

- Take Advantage of Low Mileage Discounts: Some insurers offer discounts for drivers who drive fewer miles annually.

By being proactive and exploring these strategies, Arizona drivers can potentially find ways to find the cheapest car insurance premiums.