There is no better feeling than waking up to your very own home. The pride in the accomplishment of acquiring a home is huge. You and your family have put their heart and souls into this living space. You have so much in your home that needs protection.

Homeowners Insurance is a requirement on most home that have a loan.

It is not a state law but the majority of homeowners buy it.

It is the best way to live risk-free and we would like to help you find the right kind for you and your family.

Your home is your largest personal investment and it needs protection. But finding the correct balance of coverage and cost is a difficult process.

Since 1974, Cheap Insurance has been helping homeowners find the coverage that adequately protects their investment and their family, as well as tailoring that coverage to fit their budget.

We have been a leader in this field over over 40 years and have all of the answers to your questions. Let us make this insurance buying process easy. Get your hands on the cheap homeowners insurance you and your family need.

Facts About Homeowners Insurance

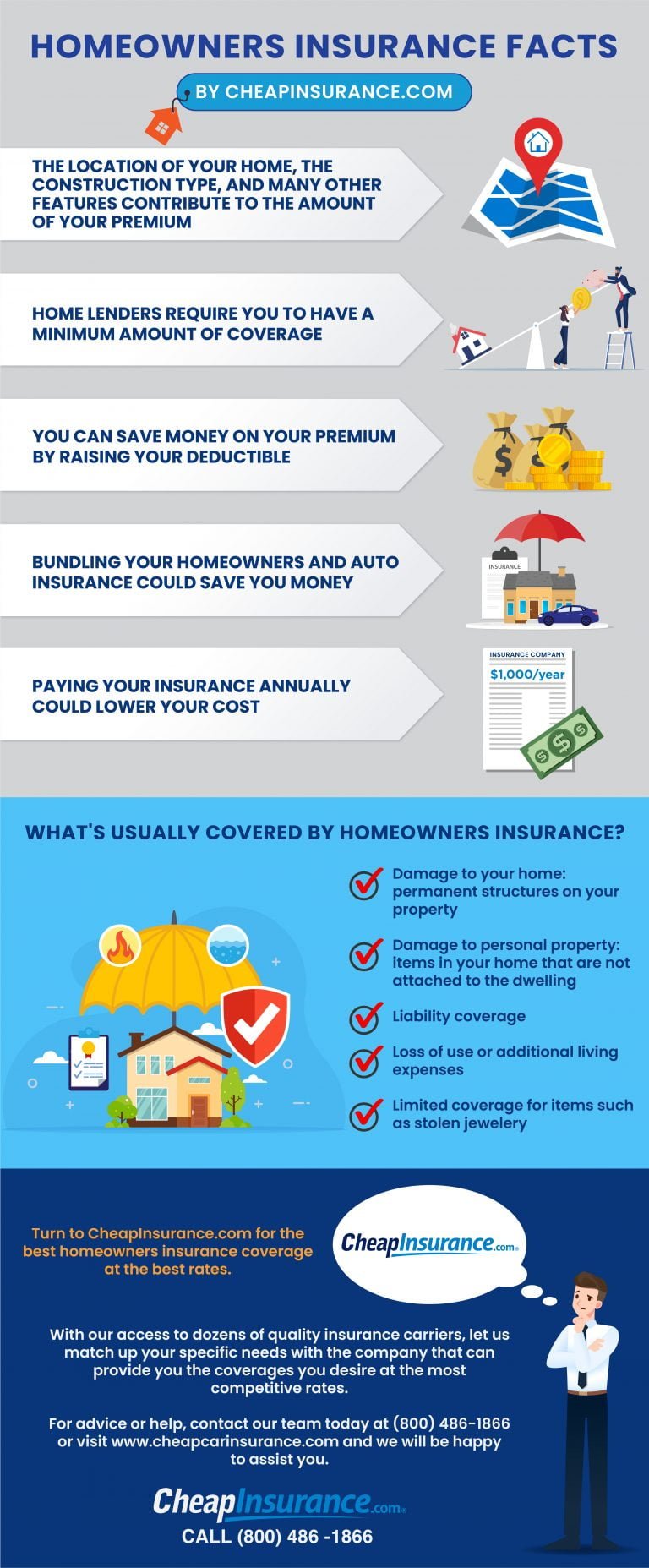

- When you purchase a home, home lenders require you to have a minimum amount of coverage in order to protect what they are financing.

- Homeowners insurance is in place in case a disaster such as a fire occurs and your home is destroyed. You will need it insured to pay off the loan on the home and recover damages.

- Credit can be an important rating factor when looking for homeowners insurance. The difference in cost between someone that has excellent credit versus poor credit is nearly half.

- Homeowners insurance covers four basic types of insurance: structure, personal belongings, liability, and additional living expenses.

- The location of your home, the construction type, roof slope and many other features contribute to how much your homeowners insurance will be.

- You can save money on your premium by raising your deductible.

- You can bundle your insurance to save! Putting homeowners and auto together, for example, could save.

- You may also want to pay for your insurance annually to save on costs.

- There are many discounts available to you if you ask. If you live by a fire department, have home safety devices like an alarm, have a deadbolt on your door, or have a good credit history you could save.

There's No Place Like Home. Make Sure It's Fully Protected.

Turn to CheapInsurance.com for the best homeowners insurance coverage at the best rates.

With our access to dozens of quality insurance carriers, let us match up your specific needs with the company that can provide you the coverages you desire at the most competitive rates.

We want to be there when you need us most and help get you back to your home in the event of a loss.

Start here with an online quote and free evaluation for homeowners insurance today.

- You have a few different types of coverage: a cash value coverage, a replacement cost coverage and a guaranteed or exceeded cost coverage.

- Not every type of damage is covered by homeowners insurance. Ask your agent if you have something specific you would like covered.

- If you have a home-based business, your homeowners insurance could be a tax write off.

- Neglect of the home is a red flag for insurance companies. If your home is in bad shape or something is damaged because of negligence, they may not pay out.

- Depending on what kind of dog you have, your liability insurance may not cover that particular breed in the case of a dog bite.

- Know that every time you make a claim, your premiums could go up.

- There is a deadline for making a claim on your homeowners insurance policy. There is usually a two week window to do so.

- It is always a good idea to make an inventory of the valuables in your home. You could always take pictures or video of the things you have and add up the costs.

- Insurance companies do take into consideration the depreciation of value on goods in your home.

- An insurance company cannot just cancel your insurance. They have to have a good reason such as failure of payments.

- If you plan to remodel your home, make sure you check in with your agent. Your reconstruction is not automatically covered in your insurance policy.

- Damage to your home, including permanent structures on your property—unless your policy specifically excludes the cause of the damage

- Damage to personal property, meaning the items in your home that are not attached to the dwelling, due to causes outlined in your policy

- Liability coverage for legal matters or accidents that occur on your property

- Loss of use, which allows you to maintain your lifestyle at another residence while your home is being repaired without incurring additional costs

- Limited coverage for items such as stolen jewelry—the amount of coverage varies depending upon state of residence, and you always have the option to increase this coverage.

- Additional coverage available for more valuable items (jewelry, fur, silverware, etc.). If coverage above the limited coverage amount is required, a “rider” should be purchased. This coverage offers a broader range of perils.

Save Money on Your Homeowners Insurance Today

Do you qualify for discounts on your homeowners insurance? Check this list to see a sampling of the discounts CHEAP Insurance offers:

- Monitored home alarm system- having an alarm system could deter burglaries and looks great to insurance companies.

- Doors fortified with security locks- having a deadbolt lock is a sure-fire way to save you money.

- Smoke detectors- this is not only a super safe idea for your family but could literally save lives.

- Sprinkler system- these are more expensive to install, however this could save you money and pay off if something in your home catches fire.

- Gated community- Living in a gated community usually means a safer environment in general.

- Retirement community- retirement communities usually have their own security in place.

- Newly purchased home- Newly purchased homes usually come with sprinkler systems, smoke detectors and good quality locks.

- Age of home discount- depending on the age of your home, you could save on your insurance.

What If I Have A Pool?

Usually a standard liability policy with homeowners insurance is around $100,000. When you have a pool in your house, the suggested amount of liability coverage goes up to $500,000. Why? Pools are considered dangerous to visitors. If you have a fence around your pool, this is a great way to make it safer. When kids and adults alike come to visit, pools can be hazardous especially when drinking. Some people do not know how to swim, yet this is rarely disclosed when someone enters your home. Be aware of the dangers of pools for children and have the correct amount of liability coverage just in case.

What If I Lease My Home to Tenants?

Renting your home can be a good extra source of income, or a way to manage its expenses. If you rent your home to a tenant, you need a specific type of homeowners insurance, known as a “dwelling fire” policy. CheapInsurance.com offers the cheapest rates and can assist you in making sure your home is covered in all types of circumstances. Contact us to request more information on Dwelling Fire policies.

Consider renters insurance

Tenants who live in a rental property should consider an inexpensive renter’s insurance policy. Have you ever added up the value of the items in your dresser alone? Try adding up the value of all the spices in your cabinet. Replacing them could be more costly than most people realize. The simple things we take for granted take more than a few dollars to replace. Renters insurance can assure that your jewelry, plasma television, and that amazing stereo you can’t wait for people to listen to when they come over can be replaced in case of fire, flood, or theft.

- Monitored home alarm system- having an alarm system could deter burglaries and looks great to insurance companies.

- Doors fortified with security locks- having a deadbolt lock is a sure-fire way to save you money.

- Smoke detectors- this is not only a super safe idea for your family but could literally save lives.

- Sprinkler system- these are more expensive to install, however this could save you money and pay off if something in your home catches fire.

- Gated community- Living in a gated community usually means a safer environment in general.

- Retirement community- retirement communities usually have their own security in place.

- Newly purchased home- Newly purchased homes usually come with sprinkler systems, smoke detectors and good quality locks.

- Age of home discount- depending on the age of your home, you could save on your insurance.

Learn These Terms And Be Prepared

- Defensible Space: A designated area around a fireplace or other hazard to prevent fires or accidents.

- Depreciation: When the actual value of property is lowered to reflect age, misuse or neglect.

- Extended Replacement Cost: Additional coverage for replacement value of your property. If labor and material costs rise you may not be able to replace your property to its previous condition at the market value.

- Fire Insurance: Coverage that pays for loss associated with fire.

- Flood Insurance: Additional coverage that covers for loss associated with flood waters. This coverage may be mandatory depending on the zoning laws of your area.

- Homeowners Insurance: A policy in which covers the homeowner’s property and also liability coverage for anyone injured at his property.

- Manufactured home coverage: Coverage specifically for mobile homes.

- Mortgage Guarantee Insurance: Coverage to protect mortgage companies from default on a homeowners loan.

- National Flood Insurance Program (NFIP): An insurance risk pool that helps defray the insurance companies costs associated with severe flooding.

- Premium: The cost of the policy that must be paid in order to be covered.

- Property Damage Coverage: Coverage for any damage to your property such as broken windows.

- Rental Property: Any property that is leased or rented.

- Umbrella Policy: Provides personal liability insurance when other policies are not effective at covering all possible events under the current policies.

- Water Damage Policy: Covers damage to property caused by water damage such as plumbing issues but not flood water.

f you are ready to make that leap into homeownership, then talk to us. We can help you save and feel secure in your new home. There are a couple of ways to contact us:

Call CHEAP Insurance today (800) 486-1866 and speak with one of our insurance specialists who will assist you in making sure all your property is fully insured.

Learn more about Renter’s Insurance.

You can get your instant online quote now.

- Just click the quote button on the top of this page.

- fill in your product (homeowners insurance)

- put in your zip code

- answer a few questions.

You will have your quote and policy information delivers to your e-mail inbox in a matter of minutes. You are also welcome to come into our office and sit down with a helpful representative.

If you are in Los Angeles, Stockton, San Francisco, Oakland, Sacramento or anywhere in California, then Cheap Insurance is your one stop shop for all your discount online insurance needs.

We would like to show you how 40 years of experience pays off. Be proud to be a homeowners and slash the price of your insurance by calling us today!

Our name and our prices may be CHEAP, but quality is what we sell. Let us give you a no obligation, hassle free, quote.

Call today to start saving!

- Choose your product: home insurance

- Enter your zip code: where you live determines which carriers are available and can effect your rates

- Get a list of carriers that are available in your area

- Click a carrier to get your instant quote!

You can find the best cheap car insurance quotes in as little as a few minutes.

Reviewing our insurance guides at CheapInsurance.com can be helpful when learning about what policies, and coverages you may need. Being prepared and organized when purchasing insurance will pay off in large ways. Talking to a representative will be the key to obtaining the best insurance policies for you and your family. Our job is not only to provide you with the best coverage and the best customer service, but also to make sure you know exactly what you are purchasing and what it covers. At CheapInsurance.com, we know that you’re not looking for cheap insurance, but insurance for cheap! At CheapInsurance.com we appreciate your business and look forward to a long and successful relationship with you and your family. Let us help you find the insurance policy you deserve today!