CheapInsurance.com has put together information, tips, and price comparisons to help you find car insurance in New Jersey.

New Jersey’s long and attractive coastline with more than 50 seaside resort towns has made it a desirable vacation destination.

It’s referred to as the Garden State, which is apt because New Jersey is one of the most agriculturally diverse states with a wide variety of fruits and vegetables, and flowers and trees.

The state, one of the most densely populated in the U.S., also lays claim to noteworthy musical legends—Bruce Springsteen, Jon Bon Jovi, and Frank Sinatra all hail from New Jersey.

New Jersey is the birthplace of modern inventions such as FM radio, the motion picture camera, the lithium battery, the light bulb, transistors, and the electric train.

The average cost of car insurance in New Jersey for full coverage is $1,891 per year or around $158 per month.

This is almost 7% higher than the national average cost of car insurance.

Garden State Cruising: Updates & Insurance Insights for New Jersey 2024

Get ready to explore the Jersey Shore, bustling cities, and charming towns with these key updates for New Jersey drivers in 2024

New Jersey Vehicle Code Changes:

- Illegal sale/purchase of catalytic converters: New regulations crack down on scrapyards accepting stolen converters, aiming to combat car thefts. (Source: New Jersey Senate Bill 89)

- Limited driving permits for certain offenders: New restrictions on driving after certain violations for specific DUI/DWI offenders. (Source: New Jersey Senate Bill 220)

- Development impact fees for education: Local governments gain the ability to impose fees on new developments for educational funding. (Source: Georgia Legislation GA/legislation)

Remember: These are just highlights, and other changes may apply. Visit the New Jersey Motor Vehicle Commission website for complete information. (Source: New Jersey Motor Vehicle Commission)

Average Auto Insurance Rates in New Jersey (2024):

(Sources: The Zebra, ValuePenguin)

Company | Full Coverage | Minimum Coverage |

State Farm | $1,380 | $560 |

GEICO | $917 | $495 |

Progressive | $1,224 | $487 |

Farmers | $1,359 | $612 |

Travelers | $1,244 | $541 |

Remember: Individual rates in New Jersey can vary significantly based on driving history, location, vehicle type, and desired coverage.

Comparing quotes from other car insurance companies is always a good idea to ensure you’re getting the best rate on your insurance.

To help you find the best deals on car insurance in the state, we’ve compared quotes from these car insurers:

- Plymouth Rock.

- Mercury.

- Bristol West.

- Midvale.

- Travelers.

- AAA Insurance.

- Allstate.

To help you find the best deals on car insurance in the state, we’ve compared quotes from car insurers in these five New Jersey counties:

- Bergen County.

- Middlesex County.

- Essex County.

- Hudson County.

- Monmouth County.

Because the cost of car insurance is highly dependent on your individual driving profile, we’ve gone a step further and compared the cost of car insurance for these types of drivers:

- Good drivers (those with a clean driving record).

- Young drivers (those aged between 16 – 25).

- Bad drivers (those with a history of traffic violations).

Is It Legal to Drive without Car Insurance in New Jersey?

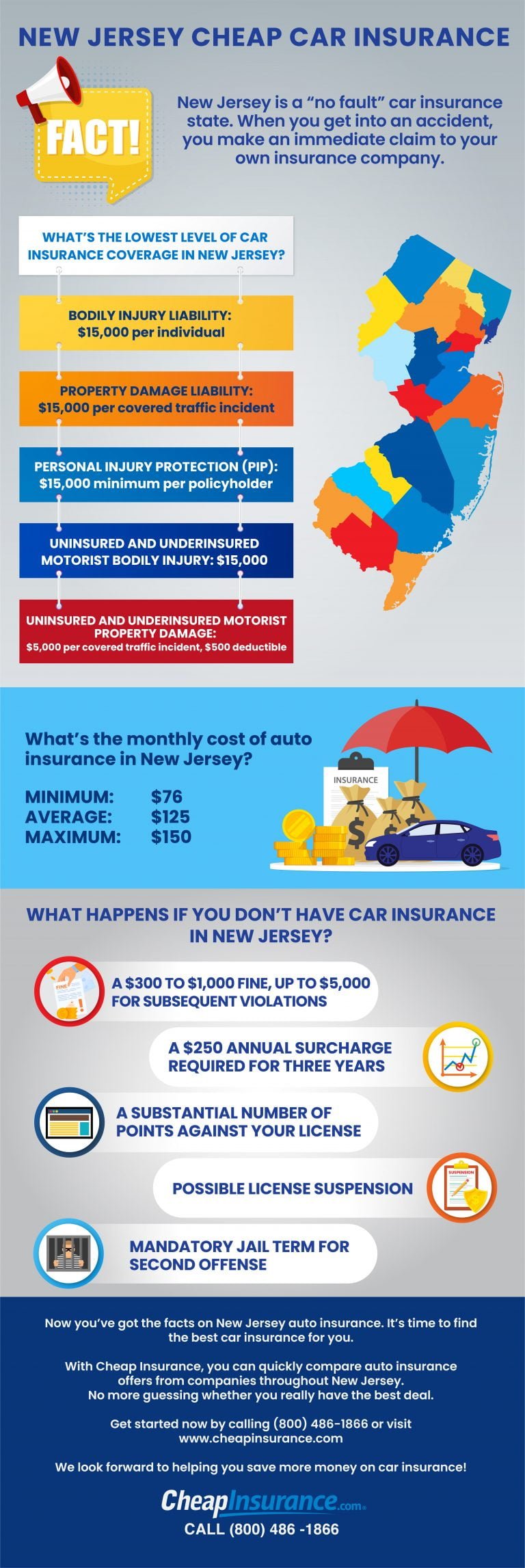

Car insurance is mandatory in the state of New Jersey. Every driver is required to carry three types of auto insurance:

- Personal liability insurance.

- Uninsured/underinsured motorist coverage.

- No-fault insurance.

Drivers who get caught driving a car that is not insured face serious consequences. The fine for a first offense is between $300 and $1,000, as well as a stint of community service.

Drivers caught without insurance could have their license suspended for up to one year, or until proof of coverage is provided. The license reinstatement fee in New Jersey is $100.

Minimum Liability Insurance

Liability insurance is designed to protect third parties and their property from damage you may cause while driving. It does not cover any damages to your own vehicle.

While each U.S. state will have different minimum coverage car insurance requirements, it always addresses three key points:

- Bodily injury coverage per person: This covers medical bills, legal fees, or lost wages you might be required to pay to an individual third party.

- Bodily injury coverage per accident: This is the maximum amount your insurer will pay out for medical bills, legal fees, or lost wages in the event of an accident, regardless of how many people are injured.

- Property damage coverage per accident: This is the maximum amount your insurer will pay out for repairs or a replacement if you cause damage to another person’s property.

To drive a car in New Jersey, the state-mandated minimum coverage car insurance requirements are:

- $15,000 per person for injury or death.

- $30,000 per accident for all injuries.

- $5,000 for property damage.

- $15,000 per person for personal injury protection.

These are just the minimum requirements and you can pay for a policy with greater coverage.

Key Point. Personal Injury Protection Personal injury protection (PIP) is auto insurance that covers you for your injuries from a car accident no matter who is at fault. This means that you will receive benefits whether you are a bystander, a passenger, or a driver. PIP coverage can help with several medical expenses, as well as nonmedical expenses like lost wages. In New Jersey, you need a minimum of $15,000 in PIP coverage. |

How Much Does Minimum Car Insurance Cost in New Jersey?

Car insurance costs in New Jersey can vary considerably based on factors such as:

- Your age.

- Driving history.

- ZIP code.

- Make and model of the vehicle.

- Credit score.

All drivers in New Jersey have to meet the minimum coverage of car insurance.

If you’re found to be the cause of a car accident but you do not have enough insurance coverage, you will be held personally responsible for paying the other party’s medical bills, legal bills, and lost wages.

Key Point: Is Minimum Liability Coverage Enough? While it may seem like a good idea to save money by getting only the minimum liability insurance required to comply with New Jersey law, this may not be sufficient in many instances. Let’s look at an example. The New Jersey minimum coverage for property damage is $5,000. If, for example, you are the cause of an accident and you only have minimum liability coverage, you will have to pay out of pocket for damages to the other party that exceed $5,000. Remember, minimum liability insurance only protects third parties and doesn’t reimburse you if your car is stolen, damaged, or totaled. |

We have found that on average, the cost of a minimum liability car insurance policy in New Jersey is $224.18.

Mercury offers the lowest car insurance rates for minimum liability coverage on average, costing $31.00.

| Cheapest Minimum Liability Car Insurance | ||||||

| Provider | Bergen County | Middlesex County | Essex County | Hudson County | Monmouth County | Average |

| Mercury | $181.00 | N/A | $223.00 | $196.00 | $144.00 | $31.00 |

| Plymouth Rock | $136.00 | $117.00 | $212.00 | $191.00 | $112.00 | $153.60 |

| Bristol West | $360.00 | $240.00 | $388.00 | $365.00 | $266.00 | $323.80 |

| Travelers | $229.00 | N/A | $465.00 | $454.00 | $338.00 | $371.50 |

| Allstate | $241.00 | N/A | N/A | N/A | N/A | $241.00 |

| Midvale | N/A | $267.00 | N/A | N/A | N/A | $267.00 |

Find Cheap Comprehensive Car Insurance in New Jersey

You may not think that it’s necessary to get comprehensive car insurance, but if you can afford it, it could be worth your while.

Comprehensive car insurance will cover you in the event of the following:

- Theft or theft of parts.

- Non-crash damage (natural disasters, fire, flooding).

- A broken windshield.

- Car damage from hitting an animal.

Repairing car damage can easily amount to thousands of dollars.

Without comprehensive car insurance, you risk finding yourself in a situation where you are unable to drive your car because you cannot afford to repair it.

To help you find the cheapest comprehensive car insurance in New Jersey, we’ve compared the car insurance rates offered by six insurers.

We found that the three cheapest full coverage insurance companies in New Jersey are:

- AAA Insurance with average rates of $139.00.

- Plymouth Rock with average rates of $169.20.

- Mercury with average rates of $218.00

| Cheapest Full Coverage Insurance in New Jersey | ||||||

| Provider | Bergen County | Middlesex County | Essex County | Hudson County | Monmouth County | Average |

| Plymouth Rock | $155.00 | $135.00 | $247.00 | $180.00 | $129.00 | $169.20 |

| Mercury | $214.00 | N/A | $262.00 | $233.00 | $163.00 | $218.00 |

| Bristol West | $475.00 | $286.00 | $457.00 | $546.00 | $343.00 | $421.40 |

| Midvale | N/A | $267.00 | N/A | N/A | N/A | $267.00 |

| AAA Insurance | N/A | $148.00 | N/A | N/A | $130.00 | $139.00 |

| Allstate | N/A | $185.00 | $275.00 | $267.00 | $172.00 | $224.75 |

Cheap Car Insurance in New Jersey for Drivers with Clean Driving Records

You can qualify for good driver car insurance rates if you have a history of safe driving.

If your motor vehicle record is free of accidents and claims, you represent a low risk for the insurance company, resulting in lower premium costs.

Companies may offer one or both of two common types of good driver discounts:

- A discount for avoiding violations for a certain number of years.

- A discount for avoiding accident claims for a certain number of years.

Key Point: What Is a Good Driver Discount? A good driver discount is a discount on car insurance that is available to drivers who have never caused any accidents or traffic offenses during a particular period. A good driver discount (also referred to as a safe driver discount) applies to drivers who have a clean driving record and who do not have any:

|

If you are a new driver without enough experience to qualify for a good driver discount, you may want to consider enrolling in a defensive driving course in order to increase your road sense.

Some car insurance companies will offer an additional discount if you have completed an accredited defensive driving course.

We looked at the average car insurance rates offered by car insurance companies for good drivers. The three best car insurance companies for good drivers are:

- AAA Insurance with average rates of $132.50.

- Plymouth Rock with average rates of $168.40.

- Mercury with average rates of $198.75.

| Cheapest Car Insurance for Good Drivers in New Jersey | ||||||

| Provider | Bergen County | Middlesex County | Essex County | Hudson County | Monmouth County | Average |

| Mercury | $194.00 | N/A | $239.00 | $211.00 | $151.00 | $198.75 |

| Plymouth Rock | $149.00 | $129.00 | $231.00 | $210.00 | $123.00 | $168.40 |

| Bristol West | $418.00 | N/A | $516.00 | $481.00 | $305.00 | $430.00 |

| Midvale | N/A | $261.00 | N/A | N/A | N/A | $261.00 |

| AAA Insurance | N/A | $141.00 | N/A | N/A | $124.00 | $132.50 |

| Travelers | $424.00 | N/A | $368.00 | $244.00 | $185.00 | $305.25 |

Cheap Car Insurance in New Jersey for High-Risk Drivers

Car insurance companies use the term ‘high risk’ to describe drivers who are more likely to make a claim against their auto insurance policy.

Some of the offenses that may lead to being considered a high-risk driver include:

- Receiving a DUI conviction.

- Reckless driving.

- Speeding tickets.

- Driving without meeting the minimum liability coverage requirements.

- A poor credit score.

- Unpaid insurance policy premiums.

If you are a high-risk driver, New Jersey car insurance companies are likely to increase the cost of your insurance.

We’ve done the hard work of comparing quotes from various insurers to help you find the best rate.

- The cheapest car insurance company for high-risk drivers is Plymouth Rock at $197.00.

- The most expensive car insurance company for high-risk drivers is Bristol West at $482.80.

| Cheapest Car Insurance for Bad Drivers in New Jersey | ||||||

| Provider | Bergen County | Middlesex County | Essex County | Hudson County | Monmouth County | Average |

| Mercury | $269.00 | $169.00 | $249.00 | $248.00 | $205.00 | $228.00 |

| Plymouth Rock | $208.00 | $155.00 | $238.00 | $216.00 | $168.00 | $197.00 |

| Bristol West | $609.00 | $343.00 | $511.00 | $516.00 | $435.00 | $482.80 |

Cheapest Car Insurance in New Jersey for Young Drivers

Young drivers are, by default, less experienced than older drivers. Their inexperience poses a higher risk to insurance companies, so their car insurance is often more expensive.

We’ve compared the cost of car insurance for young drivers to help you save on auto insurance costs. The cheapest car insurance for young drivers is Plymouth Rock at $209.00.

| Cheapest Car Insurance for Young Drivers In New Jersey | ||||||

| Provider | Bergen County | Middlesex County | Essex County | Hudson County | Monmouth County | Average |

| Plymouth Rock | $202.00 | $176.00 | $266.00 | $234.00 | $167.00 | $209.00 |

| Bristol West | $421.00 | $327.00 | $531.00 | $489.00 | $313.00 | $416.20 |

| Travelers | $429.00 | N/A | N/A | N/A | N/A | $429.00 |

| Midvale | N/A | $377.00 | $501.00 | $536.00 | N/A | $471.33 |

Need Cheap Car Insurance in Other States?

Out-of-state insurance is illegal in almost all U.S. states and is considered to be insurance fraud. This means that your car insurance must be registered in the state in which you live.

Some of the penalties for committing insurance fraud include:

- Up to five years in prison.

- A $50,000 fine.

If you plan to move from New Jersey, you will need to find a new car insurance company in the state you move to.

You will usually have a 90-day grace period to cancel your car insurance and get car insurance in your new state.

To find the best insurance rates in other U.S. states, read our articles below:

Top Tips for Finding Affordable Car Insurance

Consider How You Use Your Car

If you only use your car to drive short distances such as to work and the grocery store, most types of standard car insurance should cover your needs.

If, however, you have unique needs, you should check whether your car insurance company covers them.

Unique needs include:

- Multiple drivers sharing one car.

- Using your car for ride sharing.

- Using your car for work-related deliveries.

- Consolidating all of your insurance policies under one provider.

Compare Quotes from Different Car Insurance Companies

It’s always a good idea to shop around before making a decision about car insurance.

Although you can do the research yourself, going through an insurance agent can save you a lot of time and money.

The only way to be completely certain that you’re getting the best rates on your car insurance is to compare quotes from multiple insurers.

To save time, you can go through a licensed insurance agent or compare quotes from different insurance providers by using our online quote finder.

Top Car Insurance Companies in New Jersey

1. Mercury

Mercury Insurance, which was established in 1961, provides comprehensive coverage options for cars, homes, and businesses.

One of their selling points is providing swift and effective claims resolutions and, in collaboration with a Special Investigations Unit, they have ‘bust’ hundreds of scammers and fraud rings.

Mercury has also established authorized auto shops where they guarantee repairs to your car.

In New Jersey, Mercury Insurance offers:

- Private Passenger Auto Insurance

- Homeowners Insurance

- Condo Insurance

- Renters Insurance

- Mechanical Protection

2. Plymouth

Plymouth, which was established forty years ago, aims to offer top-quality service to its customers, agents, employees, and communities.

The company manages more than $1.7 billion in auto and home insurance premiums in a number of states, including New Jersey, New York, and Massachusetts.

Plymouth has received a financial rating of “Excellent” from the industry’s premier independent rating service, A.M. Best.

Offering rates that won’t break your budget, you can choose from several coverage options including auto insurance and home insurance, as well as other types of insurance like motorcycle and umbrella insurance.

Plymouth offers:

- New driver family discount: For policyholders who have been insured for over two years and have a licensed driver under the age of 19 listed on their policy.

- Driver improvement discount: If you’re 55 or older and complete a driver improvement course, you could save money.

- Bundling discounts: Save money when you have multiple insurance policies, such as auto and homeowners, with Plymouth Rock.

Key Point: What Is Umbrella Insurance? Umbrella insurance provides additional protection over and above the existing limits and coverage of other insurance policies. If the value of your assets is higher than their insured amount, umbrella insurance will cover the gap if you need to make a claim. |

There is car insurance that helps to protect your car and other types of insurance that helps to protect your assets.

Navigating through your options, selecting the best coverage, and setting your limits can be confusing, so if you want to find out more about car insurance quotes, just use your zip code.

3. Bristol West

Founded in 1973, Bristol West’s national reach makes it one of the top ten biggest insurance companies in the U.S.

They’re a member of the Farmers Insurance Group of Companies, an insurance company worth $11.6 billion.

Bristol West was originally created to provide high-risk drivers with affordable insurance policies, and it has since expanded its services to all types of drivers.

Some of the benefits offered by Bristol West include:

- Multiple policy bundling discounts.

- Personalized car insurance policies.

- Rideshare coverage.

- Medical payments.

- Gap coverage.

- Towing and roadside assistance.

- Rental car reimbursement.

Car Insurance in New Jersey FAQs

Do I need to have car insurance in the state of New Jersey?

Yes, all New Jersey drivers must purchase a car insurance policy that meets state requirements.

Drivers can choose between a basic auto insurance policy or a standard auto insurance policy.

Each policy includes property damage liability, personal injury protection (PIP), and bodily injury liability (optional under the Basic policy).

What are the cheapest car insurance companies in New Jersey?

The amount you pay for a car insurance policy in New Jersey depends on several criteria, including your age, credit score, gender, previous claims, and driving history.

For minimum liability, the cheapest auto insurance on offer is $31.00 with Mercury, while the cheapest comprehensive cover is available from AAA Insurance for $139.00.

What is the best auto insurance company in NJ?

Determining the best auto insurance company in New Jersey comes down to individual preferences and needs.

When choosing the best auto insurance coverage, consider what is most important to you, such as price, coverage offerings, available discounts, or customer satisfaction.

The best car insurance company may not have the cheapest rates but may excel in another area that’s important to you.

Is car insurance expensive in New Jersey?

It depends on a number of factors such as your age, your driving record, whether you qualify for discounts, and the level of coverage you can afford.

To find the cheapest car insurance in New Jersey, we recommend comparing insurance quotes from multiple companies.

This can be a time-consuming process, so save time and find the best deals by starting your auto insurance quote now.

Minimum New Jersey Car Insurance Coverage

What are the minimum car insurance coverage requirements in New Jersey? The state’s Department of Banking & Insurance offers a guide to basic and standard auto insurance so you can choose the right coverage.

New Jersey requires minimum insurance for bodily injury and property damage liability. Drivers are required to carry at least the following auto insurance coverages:

- Property damage: $5,000 coverage for a single accident

- Bodily injury/death: $15,000 per person, $30,000 per accident

- Personal Injury Protection (PIP): $15,000 per person per accident

Getting Cheap Car Insurance In New Jersey

There are many ways to get cheap car insurance in New Jersey. Follow these tips to save big!

- Go basic: The basic insurance policy is the cheapest in New Jersey and may be all you need, especially if you have an older vehicle. You can always add to it if you want special protections.

- Compare rates: Use Cheap Insurance to compare car insurance providers and rates. It just takes a few clicks to possibly save hundreds of dollars a year.

- Ask about discounts: Ask your car insurance provider about available discounts. If you’re an A student or have a good driving history, for example, you may be able to decrease your premiums.

New Jersey Car Insurance Discounts

Most car insurance providers offer some sort of discount. Save money on car insurance coverage in New Jersey with these discounts:

- Good Driver: If you have no accidents or tickets, you can save 10-30%.

- Good Student: High school or college students with at least a 3.0 GPA can save 10% or more.

- Defensive Driving/Driver Training: New Jersey drivers who complete a classroom or online course approved by the New Jersey Motor Vehicle Commission (MVC) can receive a discount on their insurance premiums.

- Customer Loyalty: If you stay with the same car insurance provider for a minimum amount of time, you can save up to 10%.

What is the average car insurance cost in New Jersey?

The average cost for full car insurance coverage in New Jersey is $1,757 per year.

How much is car insurance per month in New Jersey?

The average cost for full car insurance coverage in New Jersey is approximately $146 per month.

What is the penalty for driving without insurance in New Jersey?

A first-time violation can result in a fine of up to $1,000, as well as license suspension and community service.

What is driving like in New Jersey?

Driving in New Jersey can be summed up in one word: crazy. There are a lot of vehicles on the road, so driving in the state is not for the faint at heart. Traffic is unavoidable and drivers are often impatient and even aggressive.

How can I save money on my car insurance policy in New Jersey?

You can get cheap car insurance in New Jersey by following these tips:

- Opt for automatic payments: When you pay your car insurance automatically, this saves the insurance company money, and they will pass on the savings to you.

- Bundle your insurance: Get homeowners and auto insurance from the same company to save money.

- Take a class: A defensive driver course can not only help you improve your driving skills but also save you money.

Other Types of Coverage

If you’re driving in New Jersey, you may want more than basic coverage. If you opt for standard coverage, you might want to consider one of these car insurance coverages:

- Uninsured Motorist Coverage (UMC)/Underinsured Motorist Coverage (UIM):

- This coverage pays you for damages caused by a motorist with inadequate insurance or none at all.

- Medical Payments Coverage:

- Physical Damage Coverage: There are two types of physical damage coverage: comprehensive and collision. Collision coverage pays for damage caused by hitting something while comprehensive coverage is for damage caused by theft, vandalism, and weather issues.

- Additional kinds of coverage: The Extra PIP Package is available under the standard policy and includes income continuation, essential services, death benefit, and funeral expense benefit.

- Endorsements and Riders

- Towing and road service: This coverage provides benefits for towing and other forms of roadside assistance, such as jump-starts and flat tires.

- Rental car reimbursement: If you cannot drive your car, this insurance pays for a rental car.

- Gap insurance: Your new car loses some value the moment it drives off the lot. Unfortunately, your car loan balance doesn’t decrease along with it, so gap insurance pays the difference.