For many Utah drivers, cruising down the highway in a shiny new car was a quintessential part of the 1980s. But along with those slick rides came another reality, car insurance. Fast forward to today, and navigating the world of car insurance in Utah can feel like a whole different ball game. So, how much have car insurance rates actually changed in Utah since the 1980s? Cheap Insurance takes a deep dive into what that might have looked like.

Key Takeaways:

- Utah car insurance rates have risen significantly since the 1980s, but inflation plays a role in the perception of the increase.

- Medical costs, repair complexity, and driving behaviors are major factors contributing to higher insurance premiums.

- Modern car safety features, while beneficial, can also increase repair costs and impact insurance rates.

- Shopping around, maintaining a clean driving record, and increasing your deductible are strategies to find affordable car insurance in Utah.

- The future of car insurance may see changes due to autonomous vehicles, new technologies, and regulatory shifts.

National Insurance Costs Since 1980

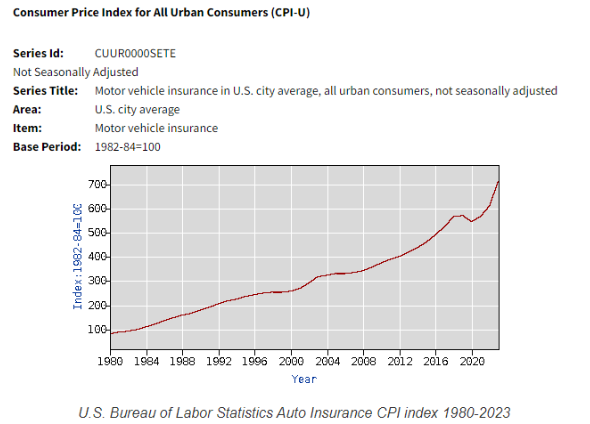

In our May 2020 reporting on How auto insurance rates have changed over the past decades we observed the following national car insurance premium trends based on U.S. Bureau of Labor Statistics data:

1980s

– Average monthly insurance premium: $119

– Premium increase from start of decade: $85 (103%)

1990s

– Average monthly insurance premium: $225

– Premium increase from start of decade: $76 (43%)

2000s

– Average monthly insurance premium: $315

– Premium increase from start of decade: $100 (39%)

2010s

– Average monthly insurance premium: $464

– Premium increase from start of decade: $196 (52%)

2020s

– Average monthly insurance premium: $564

– Premium increase from start of decade: $38 (7%)

How Much Have Car Insurance Rates Changed in Utah Since the 1980s?

The average annual car insurance premium in Utah is $1,510 according to Bankrate. The national average is $2,014, so there is quite a big difference between the two.

To put this into perspective: According to U.S. Bureau of Labor Statistics data, the monthly national average cost of auto insurance at the end of the 1980s was $119, which is 103% higher than it was at the start of the decade.

What Factors Have Caused Car Insurance Rates to Change in Utah?

- Medical Costs: Medical expenses associated with car accidents have skyrocketed since the 1980s. Advancements in medical technology, longer hospital stays, and rising healthcare costs all translate to higher insurance payouts.

- Repair Costs: Cars have become increasingly complex, with advanced technology and sophisticated materials used in their construction. Repairing these vehicles after an accident can be significantly more expensive than fixing simpler cars of the 1980s.

- Theft Rates: While national theft rates have decreased in recent decades, specific car models or areas within Utah might still experience higher theft risks. This can impact overall insurance costs.

- Driving Behaviors: Distracted driving, speeding, and DUIs have all become more prevalent concerns. Auto insurance companies in Utah factor these risky behaviors into their pricing models, leading to higher car insurance rates for drivers with poor records.

How Have Cars Themselves Impacted Insurance Rates in Utah?

The evolution of cars themselves has significantly impacted car insurance costs in Utah. Here’s how:

- Safety Features: Modern cars are packed with safety features like airbags, anti-lock brakes (ABS), and electronic stability control (ESC). While these features can significantly reduce injuries and fatalities, they also add to the repair cost of a damaged vehicle. This can lead to higher insurance premiums.

- Repair Complexity: As mentioned earlier, modern cars are complex machines. Repairing them often requires specialized tools and technicians, which can be expensive. Additionally, the increasing use of advanced materials like aluminum and carbon fiber can make repairs more costly than traditional steel repairs.

The Future of Car Insurance Rates in Utah

Predicting the future of car insurance costs in Utah is challenging, but some potential trends could influence costs:

- Autonomous Vehicles: The rise of self-driving cars could significantly impact vehicle insurance rates. If autonomous vehicles prove to be safer than human-driven cars, we might see a decrease in accidents and associated costs. However, the initial rollout of this technology might come with higher car premiums due to uncertainties.

- New Technologies: Advancements in collision avoidance technology and self-repairing materials could lower repair costs, potentially leading to the most affordable car insurance.

- Regulatory Changes: Government regulations can also influence car insurance pricing. Changes in laws regarding auto insurance coverage or accident liability could impact rates.

The National Trend

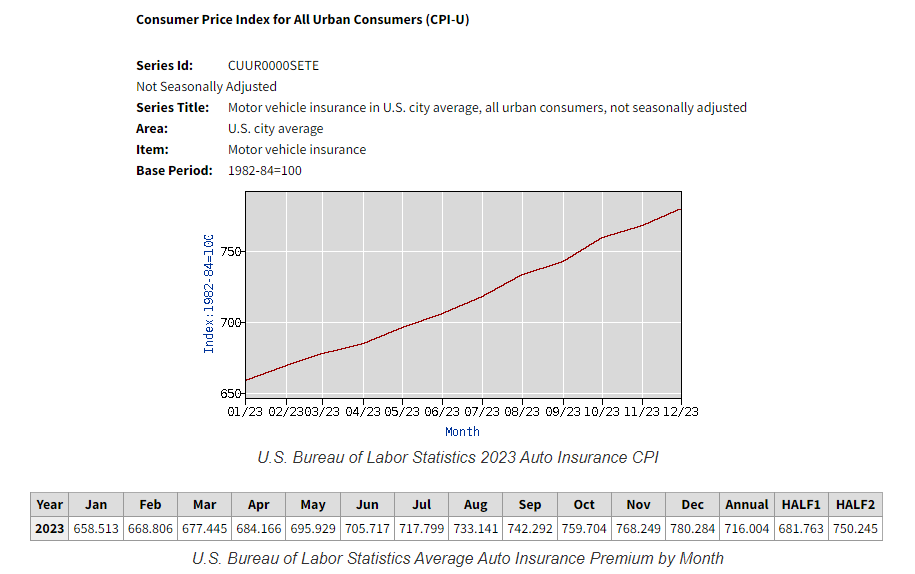

In 2023 the U.S. Bureau of Labor Statistics reported that the average annual auto insurance premium increased from $658.51 in January to $780.28 in December. The average annual auto insurance premium for all of 2023 was $716.00, with the first half of 2023 coming in at $681.76, and the second half at $750.24.

While rates for auto insurance in Utah have undoubtedly increased since the 1980s, understanding the factors behind these changes can help you make informed decisions. By being a safe driver, shopping around for the best car insurance quotes, and taking advantage of available discounts, you can still find affordable car insurance coverage in Utah today. Remember, car insurance is an essential investment that protects you financially in case of an accident. Don’t skimp on coverage in an attempt to save a few dollars upfront.