Cruising down the Las Vegas Strip with the wind in your hair and a cassette blasting your favorite 80s tunes, that’s the picture many paint when reminiscing about that era. But let’s face it, along with the rad rides came another reality, car insurance. Fast forward to today, and navigating the world of Nevada car insurance feels like a whole different ball game. Cheap Insurance takes a look at the wild changes in car insurance costs across the decades.

Key Takeaways:

- Nevada car insurance rates have risen significantly since the 1980s, but inflation plays a role in the perception of the increase.

- Medical costs, repair complexity, and driving behaviors are major factors contributing to higher insurance premiums.

- While “flashy” cars of the 80s might have been more susceptible to theft, the bigger story lies in the rise of repair costs due to modern technology.

- Modern safety features can increase repair costs, but their long-term benefits such as lower claim severity, could potentially lead to stabilized or even lower auto insurance premiums for safe drivers.

- Insurance companies in Nevada often offer discounts for vehicles equipped with specific safety features.

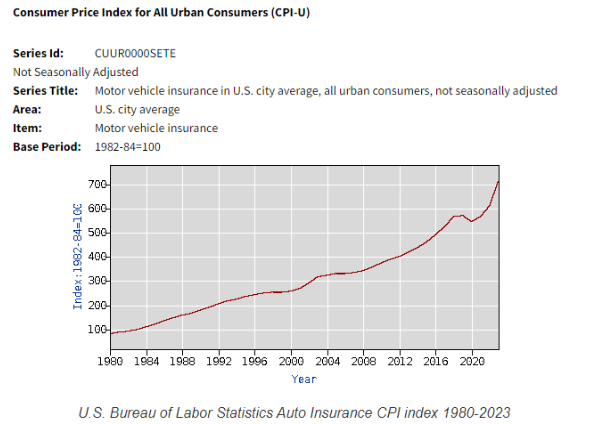

National Insurance Costs Since 1980

In our May 2020 reporting on How auto insurance rates have changed over the past decades we observed the following national car insurance premium trends based on U.S. Bureau of Labor Statistics data:

1980s

– Average monthly insurance premium: $119

– Premium increase from start of decade: $85 (103%)

1990s

– Average monthly insurance premium: $225

– Premium increase from start of decade: $76 (43%)

2000s

– Average monthly insurance premium: $315

– Premium increase from start of decade: $100 (39%)

2010s

– Average monthly insurance premium: $464

– Premium increase from start of decade: $196 (52%)

2020s

– Average monthly insurance premium: $564

– Premium increase from start of decade: $38 (7%)

Did the Rise of Flashier Cars in the 80s Impact Insurance Rates in Nevada?

The rise of flashier cars in the 1980s likely had some influence on car insurance rates in Nevada, but not necessarily in the way you might think. Here’s why:

- Performance vs. Features: While some high-performance cars were popular in the 80s, features like airbags and antilock brakes (ABS) weren’t as widespread as they are today. These features, while increasing safety, can also add to repair costs and potentially impact insurance premiums.

- Theft Rates: Certain high-performance or luxury cars from the 80s might have been more susceptible to theft, leading to higher premiums for those specific models. However, overall national theft rates have decreased since that era, potentially mitigating this impact to some extent.

The bigger story lies in the overall rise of repair costs due to increasingly complex car technology, regardless of the “flashiness” of the vehicle in the 80s.

How Much Cheaper Was Car Insurance in Nevada During the 1980s?

According to Bankrate, the average annual car insurance premium in Nevada is $2,779 and the national average is at $2,692. That makes Nevada’s car insurance cost $82 more.

To put this into perspective: According to U.S. Bureau of Labor Statistics data, the monthly national average cost of auto insurance at the end of the 1980s was $119, which is 103% higher than it was at the start of the decade.

What Factors Caused Nevada Car Insurance Rates to Soar Since the 80s?

- Medical Costs: Medical expenses associated with car accidents have skyrocketed since the 1980s. Advancements in medical technology, longer hospital stays, and rising healthcare costs all translate to higher insurance payouts.

- Repair Costs: Cars have become increasingly complex, with advanced technology and sophisticated materials used in their construction. Repairing these vehicles after an accident can be significantly more expensive than fixing simpler cars of the 1980s.

- Theft Rates: While national theft rates have decreased in recent decades, specific car models or areas within Nevada might still experience higher theft risks. This can impact overall insurance costs for those vehicles.

- Driving Behaviors: Distracted driving, speeding, and DUIs have all become more prevalent concerns. Insurance companies factor these risky behaviors into their pricing models, leading to higher auto insurance rates for drivers with poor records.

The National Trend

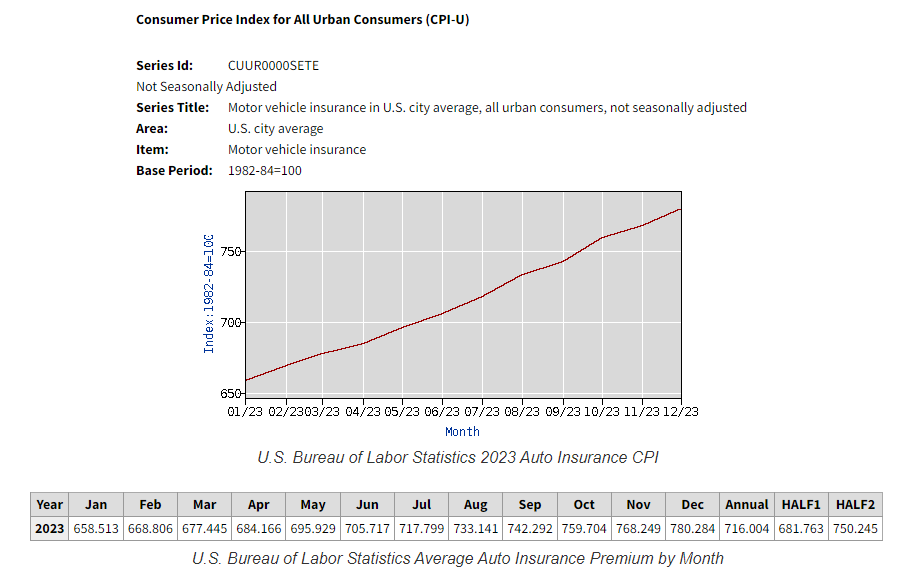

In 2023 the U.S. Bureau of Labor Statistics reported that the average annual auto insurance premium increased from $658.51 in January to $780.28 in December. The average annual auto insurance premium for all of 2023 was $716.00, with the first half of 2023 coming in at $681.76, and the second half at $750.24.

How Have Modern Safety Features Changed the Car Insurance Game in Nevada?

Modern cars are packed with safety features that were non-existent in the 80s. Airbags, ABS, electronic stability control (ESC), and lane departure warnings are just a few examples. While these features are undoubtedly positive for reducing injuries and fatalities, they also come with a price tag:

- Repair Complexity: Modern safety features often involve complex sensors and electronics. Repairing a car with these features after an accident can be more expensive than repairing a simpler car from the 1980s. This can translate to higher insurance costs for drivers.

- Replacement Costs: Safety features often add to the overall value of a car. A car with a suite of safety features might be more expensive to replace in the event of a total loss, which can also impact insurance premiums.

- Lower Claim Severity: Safety features can significantly reduce the severity of accidents, leading to lower medical costs and repair bills for insurance companies. Over time, this could potentially lead to stabilized or even reduced premiums for drivers with a history of safe driving and cars equipped with advanced safety features.

- Discounts for Safety Features: Many insurance companies in Nevada offer car insurance discounts for vehicles equipped with specific safety features. This can help offset some of the potential cost increases associated with these features.

The impact of modern safety features on auto insurance in Nevada is a complex interplay between repair costs, replacement costs, potential claim reductions, and available discounts. Exploring options to reduce premium costs can help car owners find the cheapest auto insurance quotes to maximize savings.