Texas, the land of wide-open spaces and friendly hospitality, has also become known for something less delightful: skyrocketing car insurance rates. If you drive in Texas, you’ve likely felt the sting of ever-increasing premiums. But how much have things really changed? CheapInsurance.com takes a dive into the dramatic rise of Texas car insurance rates since the 1980s.

Key Takeaways:

- Texas car insurance rates have skyrocketed since the 1980s due to rising medical costs, increased lawsuits, and more frequent natural disasters.

- Texas drivers pay significantly more than the national average for car insurance.

- Strategies like comparing auto insurance quotes, maintaining a clean driving record, and increasing your deductible can help you save on car insurance.

- Texas residents can advocate for change by contacting their state representatives, supporting consumer protection initiatives, and choosing responsible insurance companies.

- The future of car insurance rates in Texas depends on various factors, but staying informed and advocating for change can empower you to find affordable coverage.

National Insurance Costs Since 1980

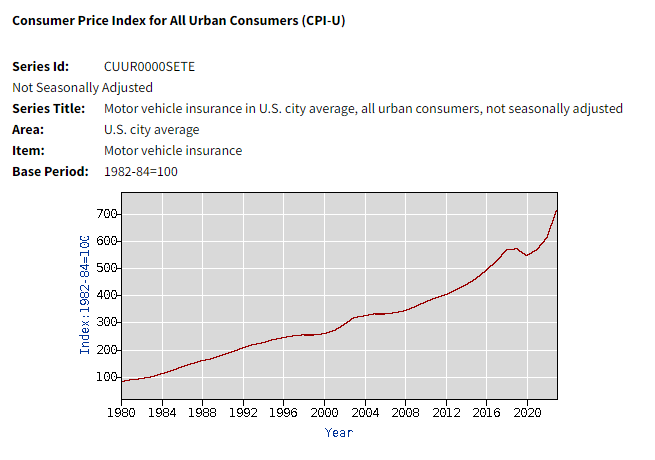

In our May 2020 reporting on How auto insurance rates have changed over the past decades we observed the following national car insurance premium trends based on U.S. Bureau of Labor Statistics data:

1980s

– Average monthly insurance premium: $119

– Premium increase from start of decade: $85 (103%)

1990s

– Average monthly insurance premium: $225

– Premium increase from start of decade: $76 (43%)

2000s

– Average monthly insurance premium: $315

– Premium increase from start of decade: $100 (39%)

2010s

– Average monthly insurance premium: $464

– Premium increase from start of decade: $196 (52%)

2020s

– Average monthly insurance premium: $564

– Premium increase from start of decade: $38 (7%)

How Affordable Was Car Insurance in Texas During the 1980s?

Compared to today’s costs, car insurance in Texas during the 1980s was significantly more affordable. While exact figures can vary depending on factors like age, driving record, and vehicle type, anecdotal evidence and historical data suggest drivers could expect to pay several hundred dollars less annually for minimum liability coverage than they do today.

Here’s a perspective: According to U.S. Bureau of Labor Statistics data, the monthly national average cost of auto insurance at the end of the 1980s was $119.

What Factored into Car Insurance Costs In Prior Decades?

Several factors influenced car insurance costs in Texas during the 1980s, some specific to the state:

- Lower Medical Costs: Medical care costs significantly impact car insurance premiums. In the 1980s, medical treatments and procedures were generally less expensive than they are today. This translated to lower payouts for insurance companies in the event of an accident.

- Fewer Lawsuits: The legal landscape in the 1980s saw fewer personal injury lawsuits related to car accidents compared to today. This meant lower legal costs for Texas insurance companies, reflected in lower premiums.

- Texas Tort Reform (1993): While not in effect during the 1980s, it’s important to acknowledge the Texas Civil Justice Reform Act of 1993 as a significant turning point. This act aimed to limit non-economic damages awarded in lawsuits, potentially impacting insurance costs in the long run.

- Less Traffic Congestion: Texas’ population has boomed in recent decades. Back in the 1980s, with a lower population density, there was likely less traffic congestion, potentially leading to a lower risk of accidents in some areas.

These factors combined created a more favorable environment for the lowest car insurance rates in Texas during the 1980s.

Understanding the Spike:

Since the 1980s, several factors have dramatically increased Texas auto insurance rates. Has Traffic Congestion in Texas Cities Impacted Insurance Rates?

Texas’ population has exploded since the 1980s. This translates to more cars on the road, leading to increased traffic congestion, especially in major cities like Houston, Dallas, and Austin. More accidents translate to more insurance claims, driving up premiums for all Texas drivers.

How Have Legal Factors and Lawsuits Affected Texas Car Insurance Costs?

While the 1993 tort reform act may have had some moderating effect, the legal landscape in Texas can still be complex. The state has a higher number of personal injury protection (PIP) claims compared to the national average. PIP coverage helps cover medical expenses for those injured in car accidents, regardless of fault. However, the abundance of lawsuits and potentially inflated medical claims associated with PIP can drive up insurance costs for all Texas drivers.

Have Natural Disasters Played a Role in Rising Insurance Rates in Texas?

Texas is prone to severe weather events like hail storms and tornadoes. These events can cause significant damage to vehicles and property, leading to a rise in insurance claims. Additionally, Texas is on the Gulf Coast, making it vulnerable to hurricanes, and floods. While less frequent than in Florida, hurricanes can still impact Texas, causing widespread damage and car insurance claims.

These factors combined – rising medical costs, increased legal activity, a more litigious climate, and a higher frequency of natural disasters – contribute to the rising car insurance rates in Texas.

How Do Today’s Texas Car Insurance Rates Compare to the National Average?

In Texas, Bankrate reports that the average car insurance premium is $2,620 annually, or $218 per month. That is $77 higher than the national average.

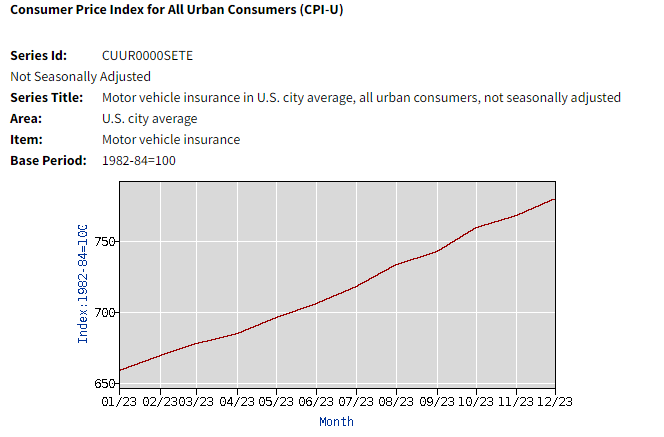

The Recent National Trend

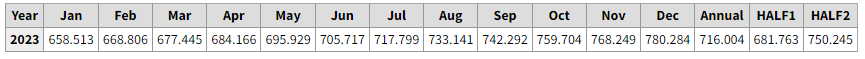

In 2023 the U.S. Bureau of Labor Statistics reported that the average annual auto premium increased from $658.51 in January to $780.28 in December. The average annual auto insurance premium overall for all of 2023 was $716.00, with the first half of 2023 coming in at $681.76, and the second half at $750.24.

What Strategies Can Texas Drivers Use to Save on Insurance Today?

While Texas car insurance rates are high, there are still ways to save:

Compare Insurance Quotes: Don’t settle for the first quote you receive. Utilize online comparison tools and contact multiple insurance companies in Texas to compare auto insurance quotes and coverage options.

Maintain a Clean Driving Record: Traffic violations and accidents significantly increase insurance premiums. Practice safe driving habits and avoid getting tickets to maintain a clean record.

Increase Your Deductible: A deductible is the amount you pay out-of-pocket before your insurance kicks in. Choosing a higher deductible can lower your auto insurance costs, but remember, you’ll be responsible for a larger upfront cost if you need to file a claim.

Take Advantage of Discounts: Many auto insurance companies offer discounts for things like good student discounts, low-mileage discounts, bundling car insurance and home insurance, completing defensive driving courses, and opting for paperless billing.

Consider Usage-Based Insurance: Usage-based insurance programs track your driving habits (telematics) and reward safe drivers with lower premiums.

The future of car insurance rates in Texas remains uncertain. While factors like technological advancements in accident prevention could lead to lower costs, others like climate change, population growth, and potential changes in the legal landscape might continue to exert upward pressure.

Staying informed about these trends and advocating for consumer-friendly policies can help Texas drivers navigate the ever-changing world of car insurance.

What Can Texas Residents Do to Advocate for Affordable Insurance Rates?

Concerned Texas residents have a few options to advocate for more affordable car insurance in Texas:

- Contact Your State Representative: Voice your concerns about rising car insurance rates to your state representative. They may support legislation aimed at addressing the issue, such as further tort reform measures.

- Support Consumer Protection Initiatives: Stay informed about and support initiatives promoting consumer protection in the car insurance industry in Texas. This might include measures to reduce fraudulent claims or limit frivolous lawsuits.

- Choose Insurance Companies Wisely: Research insurance companies and their practices. Consider supporting companies committed to fair pricing and responsible business practices in Texas.

By staying informed, shopping for the cheapest car insurance quotes, and advocating for change, Texas drivers can navigate the current insurance landscape and potentially find more affordable car insurance options.