Car insurance is an essential aspect of responsible vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. Given the financial impact of car insurance, finding the most cost-effective policy is crucial. To strike the right balance between savings and coverage, it’s important to consider how often you should obtain car insurance quotes.

An additional consideration is that most insurers have implemented default six-month premium terms, as they have begun accelerating their rate increase requests with insurance regulatory agencies in most states. With a six-month policy term, this means that the average consumer will bear the impact of these rate increases sooner than they would with a one-year term.

At CheapInsurance.com, we’ve learned that the frequency at which you should seek new insurance quotes is influenced by a variety of factors:

Your personal circumstances. Your driving history and credit score significantly impact the rates you’re offered. If you maintain a clean driving record and have a favorable credit score, you’re likely to qualify for lower premiums. However, if your driving history includes accidents, tickets, or your credit score has changed, it’s advisable to shop around more frequently.

The changes in your insurance needs. Life events like adding a new driver to your policy, purchasing a new vehicle, or altering your driving habits necessitate updated insurance quotes. Whenever your circumstances change, it’s a good idea to obtain fresh quotes to ensure your coverage remains relevant.

The cost of car insurance in your area. Most importantly, car insurance rates are not uniform across the country. Rates vary by state, and sometimes even within regions of a state. Urban areas tend to have higher insurance costs due to greater population density, increased traffic, and higher chances of accidents. If you’re moving or relocating, comparing insurance rates in your new area is essential. Nationally, car insurance cost increases from 2014 to 2023 (63.8%) have significantly grown and out-paced the cost of living (28.7% increase) and other average consumer price increases.

Key Takeaways:

- Get quotes at least once a year. The insurance market is competitive and rates can fluctuate frequently, so it’s a good idea to shop around regularly to make sure you’re getting the best deal.

- Get quotes when your circumstances change. Life events such as moving, adding a new driver, or getting a traffic ticket can all affect your insurance rates. Getting quotes when your circumstances change can help you make sure you’re still getting the best coverage for your needs.

- Compare quotes from multiple insurers. Don’t just get quotes from one insurer. Compare quotes from several different insurers to get the best possible price.

Increased rate requests take time to approve

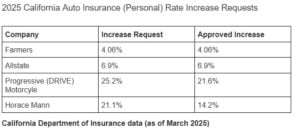

As an example, in California, insurance carriers’ requests for rate increases can take as long as a year or more to approve.

Not all carriers requested rate increases

During almost four years of the pandemic many insurance carriers received no rate increase approvals, even with the cost of materials and labor skyrocketing, which was accompanied by a major increase in the inflation rate nationally. This has led to many carriers seeking significantly higher rate increase applications in the past three years.

Annual quotes can garner best rates

Given these considerations, it’s generally recommended to obtain car insurance quotes at least once a year. By doing so, you’re more likely to secure the best possible rate and coverage.

The benefits of getting frequent car insurance quotes

Potential Savings. The insurance market is competitive, leading to frequent rate fluctuations. Regularly obtaining quotes empowers you to identify opportunities for savings by switching to insurers offering better rates.

You can get the coverage you need. Not all car insurance policies are created equal. By comparing quotes, you can make sure you’re getting the coverage you need at the best price.

Tailored Coverage. Different insurance policies offer varying levels of coverage. By comparing quotes, you can customize your policy to meet your specific needs, ensuring you’re not overpaying for coverage you don’t require.

Preparedness for Changes. Life is dynamic, and your insurance requirements may change accordingly. Regular quotes help you anticipate and manage these changes, whether it’s adding a teen driver to your policy or adjusting coverage due to lifestyle alterations.

When you should consider getting a car insurance quote

New Vehicle Purchase: When you buy a new car, it’s essential to obtain insurance quotes for the new vehicle. Factors like the car’s make, model, safety features, and potential repair costs can influence your premium.

Addition of a Driver: If you add a new driver to your policy, especially a young or inexperienced one, your rates might change. Comparing quotes can help you find the most affordable option.

Relocation: Moving to a new area can affect your insurance rates. Urban areas often have higher premiums due to increased traffic and theft rates. It’s wise to obtain quotes that reflect your new location’s insurance landscape.

Traffic Violations: A traffic violation can lead to an increase in your insurance premium. Obtaining new quotes can help you identify the most cost-effective option following a violation.

Changes in Driving Habits: If your daily commute changes significantly or if you start driving more or fewer miles, it’s advisable to seek new quotes. Adjusting your policy to match your current driving patterns can save you money.

Insurance Rate Changes: If your current insurance company raises your rates, it’s an opportunity to explore other options. Obtaining quotes from different insurers can help you find a better deal.

Policy Bundling: Many insurers offer discounts for bundling multiple policies, such as auto and homeowners insurance. Obtaining quotes for bundled policies can help you determine if this is a cost-effective choice for you.

How are auto insurance rates determined?

There are many factors that determine your auto insurance rate, including:

- Driving record. Drivers with a clean driving record pay lower rates than drivers with a history of accidents or tickets.

- Age and gender. Younger drivers and males typically pay higher rates than older drivers and females.

- Credit score. Drivers with good credit scores typically pay lower rates than drivers with bad credit scores.

- The type of car you drive. The make, model, and year of your car can affect your rate.

- Annual mileage. Drivers who drive more miles typically pay higher rates than drivers who drive fewer miles.

- Insurance coverage. The more coverage you choose, the higher your rate will be.

Zip code. The cost of car insurance can vary from zip code to zip code. This is because the risk of accidents and claims can vary depending on the area.

Focus: Zip codes and credit scores

Does your zip code really impact your auto insurance rate?

Yes, your zip code can impact your auto insurance rate. This is because the risk of accidents and claims can vary depending on the area. For example, a zip code with a high crime rate or a lot of traffic congestion will typically have higher auto insurance rates than a zip code with a low crime rate and less traffic congestion.

Does your credit score impact your auto insurance rate?

When it comes to understanding the factors that influence your auto insurance rates, you might be familiar with elements like your driving history, the type of car you own, and even your location. However, there’s another factor that has gained attention in recent years: your credit score. Yes, you read that right—your credit score can potentially affect the cost of your auto insurance premium.

So—does your credit score impact your car insurance rate? Yes, to some degree—but not in every state.

The Credit Score Factor

Your credit score is a numerical representation of your creditworthiness, calculated based on various factors including your payment history, credit utilization, length of credit history, types of credit used, and recent credit inquiries. Traditionally, credit scores were mainly associated with borrowing money, such as getting a loan or credit card. However, insurance companies have started using credit scores as a predictive tool to assess the likelihood of an individual filing a claim and their potential risk as a policyholder.

The Link Between Credit Scores and Insurance Rates

Insurance companies argue that there’s a correlation between an individual’s credit score and their likelihood of filing a claim. According to some studies, individuals with lower credit scores tend to file more claims compared to those with higher credit scores. This has led insurers to believe that a person’s financial responsibility, as reflected in their credit score, can also indicate their level of responsibility behind the wheel.

While the relationship between credit scores and insurance claims might be statistically significant, critics argue that using credit scores as a factor in determining insurance rates can be unfair. They point out that financial hardships can negatively impact credit scores and that this practice disproportionately affects lower-income individuals who might be struggling due to circumstances beyond their control.

States that do not use credit scores in insurance rates

It’s important to note that the use of credit scores in determining auto insurance rates is not universal across all states. As of September 2021, the following states have prohibited or severely restricted the use of credit scores in calculating insurance premiums:

- California

- Hawaii

- Massachusetts

- Michigan

- Oregon

- Utah

These states have either banned the use of credit scores entirely or have implemented strict regulations regarding their use in insurance pricing. It’s worth checking with your state’s insurance regulatory authority for the most up-to-date information on this topic, as regulations may have evolved.

While the relationship between credit scores and auto insurance rates might be a contentious topic, it’s clear that in many states, credit scores do play a role in determining the cost of insurance premiums. Understanding how credit scores impact your insurance rates can help you be better prepared when shopping for auto insurance. If you reside in a state where credit scores are not utilized in insurance rate calculations, count yourself lucky, as you can focus more on other factors that influence your premium. Shop around and compare quotes from different insurers to find the best coverage at the most reasonable price.

Why your auto insurance premium may have gone up

There are a few reasons why your auto insurance premium may have gone up. These include:

- An increase in the cost of claims. The cost of car insurance claims has been rising in recent years, due to factors such as the increasing cost of repairs and medical care.

- A change in your driving record. If you’ve gotten a speeding ticket or other traffic violation, your insurance company may raise your rate.

- A change in your credit score. If your credit score has decreased, your insurance company may raise your rate.

- A change in your car. If you’ve bought a new car or a car with a higher value, your insurance company may raise your rate.

- A change in your insurance coverage. If you’ve increased your coverage limits or added additional coverage, your insurance company may raise your rate.

Will auto insurance rates ever decrease?

Auto insurance premiums have been on the rise in recent years, and there is no indication that they will decrease anytime soon. In fact, some experts believe that premiums could continue to rise in the coming years.

There are a few reasons for the rising cost of auto insurance. One reason is the increasing cost of claims. As cars become more expensive, the cost of repairing or replacing them in the event of an accident also increases. Additionally, the number of uninsured and underinsured drivers is also on the rise, which can drive up the cost of premiums for everyone.

Another reason for the rising cost of auto insurance is the slow response from regulatory bodies in various states in granting premium rate increases to insurance companies. During the pandemic, many states prevented insurance companies from raising premiums, even though the cost of claims was increasing. This has led to a backlog of rate increases that are now being granted, which is putting upward pressure on premiums.

So, will auto insurance premiums ever decrease? It is possible, but it is not likely in the near future. There are a number of factors that are driving up the cost of auto insurance, and it will take time for these factors to be addressed. In the meantime, drivers can expect to continue paying higher premiums.

Recent news reports about insurance companies not being able to raise premium rates during the pandemic:

- In April 2020, the Illinois Department of Insurance issued an order prohibiting insurance companies from raising premiums for personal auto insurance policies. The order was in effect for six months and was designed to help drivers who were struggling financially due to the pandemic.

- In May 2020, the California Department of Insurance issued a similar order prohibiting insurance companies from raising premiums for personal auto insurance policies. The order was also in effect for six months.

These are just two examples of the many states that took steps to prevent insurance companies from raising premiums during the pandemic. These orders have had a significant impact on the cost of auto insurance, and it is likely that premiums will continue to rise in the coming years as these orders are lifted.

The very slow response from regulatory bodies in various states in granting premium rate increases to insurance companies in 2025:

Even though the pandemic is over, many states are still taking a slow approach to granting premium rate increases to insurance companies. This is due to a number of factors, including concerns about the impact of higher premiums on consumers and the desire to ensure that insurance companies are not overcharging.

As a result of this slow response, many insurance companies are facing financial pressure. They are paying out more in claims than they are taking in in premiums, and they are struggling to make a profit. This could lead to some insurance companies going out of business, which would further increase the cost of auto insurance for consumers.

What can I do to lower my auto insurance premium?

There are a few things you can do to lower your auto insurance premium:

- Maintain a good driving record. The best way to lower your auto insurance rate is to have a clean driving record. This means no accidents or tickets.

- Improve your credit score. If your credit score is low, you can improve it by paying your bills on time and reducing your debt.

- Drive a safe car. Cars with safety features, such as airbags and anti-lock brakes, typically have lower insurance rates.

- Increase your deductible. By increasing your deductible, you can lower your monthly premium. However, you should make sure that you can afford to pay the deductible if you have a claim.

- Shop around for quotes. It’s important to shop around for quotes from several different companies before you buy car insurance. This is the only way to make sure you’re getting the best rate.

- Bundle your auto insurance with other policies. Many insurance companies offer discounts for bundling your auto insurance with other policies, such as homeowners or renters insurance.

By taking these steps, drivers can save money on their auto insurance premiums. However, it is important to remember that there is no guarantee that premiums will ever decrease. The cost of auto insurance is determined by a number of factors, and it is possible that premiums will continue to rise in the future.

Wrapping it up

In conclusion, it is important to obtain car insurance quotes at least once a year to ensure you are getting the best possible rate and coverage. Life changes, regional differences, and fluctuations in the insurance market make regular comparison essential for financially savvy car owners. By staying proactive, you can secure suitable coverage while optimizing your budget.

Here are some of the key points to remember:

- The frequency at which you should obtain new insurance quotes is influenced by a variety of factors, including your personal circumstances, the cost of car insurance in your area, and the changes in your insurance needs.

- It is generally recommended to obtain car insurance quotes at least once a year.

- There are many benefits to getting frequent car insurance quotes, including potential savings, getting the coverage you need, tailored coverage, and preparedness for changes.

- When seeking car insurance, it is important to compare quotes from various providers to ensure you are getting the best possible rate.

- To effectively compare quotes, you should ensure the quotes you are comparing offer the same level of coverage and factor in all variables, such as your driving history, age, gender, and vehicle type.

- You should also read the fine print of each policy to understand what is covered and what is not.

- The cost of car insurance is determined by a variety of factors, including your driving record, age and gender, credit score, the type of car you drive, your annual mileage, your insurance coverage, and your zip code.

- Your credit score can impact your auto insurance rate in some states.

- There are a number of states that do not use credit scores in determining insurance premiums.

- There are several steps you can take to lower your car insurance costs, including maintaining a good driving record, driving a safe car, increasing your deductibles, and bundling your car, home or rental coverages.

Before You Go:

- Be sure to compare quotes for the same level of coverage. Different insurers may offer different levels of coverage, so it’s important to compare quotes for the same level of coverage to make an apples-to-apples comparison.

- Read the fine print. Don’t just look at the price of the quote. Be sure to read the fine print to understand what is and isn’t covered by the policy.

- Don’t be afraid to negotiate. Once you’ve gotten quotes from a few different insurers, don’t be afraid to negotiate with your current insurer to see if they can match or beat the price of the other quotes.

Fausto Bucheli Jr. has been the president and owner of CheapInsurance.com since 2005. With an MBA in marketing from the University of La Verne in California and a license as an insurance broker in California for 20 years, Bucheli brings extensive knowledge and expertise to his role. Having a strong background in the automotive industry and car insurance, he understands the unique challenges customers face when insuring their vehicles.