Cruising down a scenic Idaho highway might feel like a timeless experience. However, the cost of car insurance in the Gem State has certainly changed over time. This article dives deep into the reasons behind the rising costs of car insurance in Idaho since the 1980s. Buckle up as Cheapinsurance.com explores the factors contributing to this trend.

Key Takeaways:

- Idaho car insurance rates have risen significantly since the 1980s, but inflation plays a role in the perception of the increase.

- Medical costs, repair complexity, and driving behaviors are major factors contributing to higher auto insurance premiums.

- Changes in Idaho law, like at-fault accident regulations or coverage requirements, can impact insurance costs.

- Car insurance rates can vary depending on location within Idaho, with factors like population density and accident rates influencing premiums.

- Modern safety features can increase repair and replacement costs, but their long-term benefits (lower claim severity) could potentially lead to stabilized or even reduced rates for safe drivers.

National Insurance Costs Since 1980

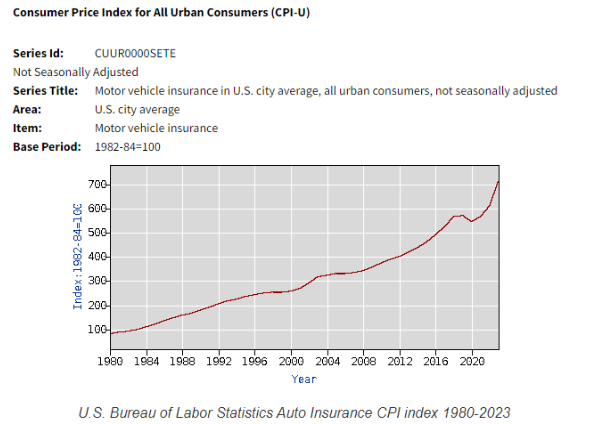

In our May 2020 reporting on How auto insurance rates have changed over the past decades we observed the following national car insurance premium trends based on U.S. Bureau of Labor Statistics data:

1980s

– Average monthly insurance premium: $119

– Premium increase from start of decade: $85 (103%)

1990s

– Average monthly insurance premium: $225

– Premium increase from start of decade: $76 (43%)

2000s

– Average monthly insurance premium: $315

– Premium increase from start of decade: $100 (39%)

2010s

– Average monthly insurance premium: $464

– Premium increase from start of decade: $196 (52%)

2020s

– Average monthly insurance premium: $564

– Premium increase from start of decade: $38 (7%)

How Much More Expensive Has Car Insurance Become in Idaho Since the 1980s?

According to Bankrate, the average annual premium for auto insurance in Idaho is $1,427. This is much lower than the national average of $2,527.

To put this into perspective: According to U.S. Bureau of Labor Statistics data, the monthly national average cost of auto insurance at the end of the 1980s was $119, which was 103% higher than it was at the start of that decade.

What Factors Are Driving Up Car Insurance Costs in Idaho?

Several factors have contributed to the rise of car insurance rates in Idaho, beyond inflation:

- Medical Costs: Medical expenses associated with car accidents have skyrocketed since the 1980s. Advancements in medical technology, longer hospital stays, and rising healthcare costs all translate to higher insurance payouts.

- Repair Costs: Cars have become increasingly complex, with advanced technology and sophisticated materials used in their construction. Repairing these vehicles after an accident can be significantly more expensive than fixing simpler cars of the 1980s.

- Theft Rates: While national auto theft rates have decreased in recent decades, specific car models or areas within Idaho might still experience higher theft risks. This can impact overall insurance costs for those vehicles.

- Driving Behaviors: Distracted driving, speeding, and DUIs have all become more prevalent concerns. Insurance companies factor these risky behaviors into their pricing models, leading to higher auto insurance rates for drivers with poor records.

How Have Changes in Idaho Law Impacted Car Insurance?

Changes in Idaho laws can also influence car insurance costs. Here are some potential areas to consider:

- At-Fault Accident Laws: Idaho follows a modified comparative negligence system. This means that fault for an accident is shared proportionally between drivers. Changes in how fault is determined or the percentage thresholds for assigning blame could impact auto insurance costs.

- Coverage Requirements: Minimum liability coverage requirements in Idaho might have changed since the 1980s. Increases in required coverage levels could lead to higher premiums.

Do Car Insurance Rates Vary Significantly Across Different Areas of Idaho?

Yes, car insurance rates can vary significantly across different areas of Idaho. Here’s why:

- Population Density: Urban areas with higher traffic congestion and accident rates might see higher insurance premiums compared to rural areas.

- Theft Rates: Areas with higher rates of car theft will likely have higher insurance costs for vehicles considered more susceptible to theft.

- Accident History: If a particular area experiences a higher frequency of accidents, car insurance companies might adjust rates to reflect the increased risk.

The National Trend

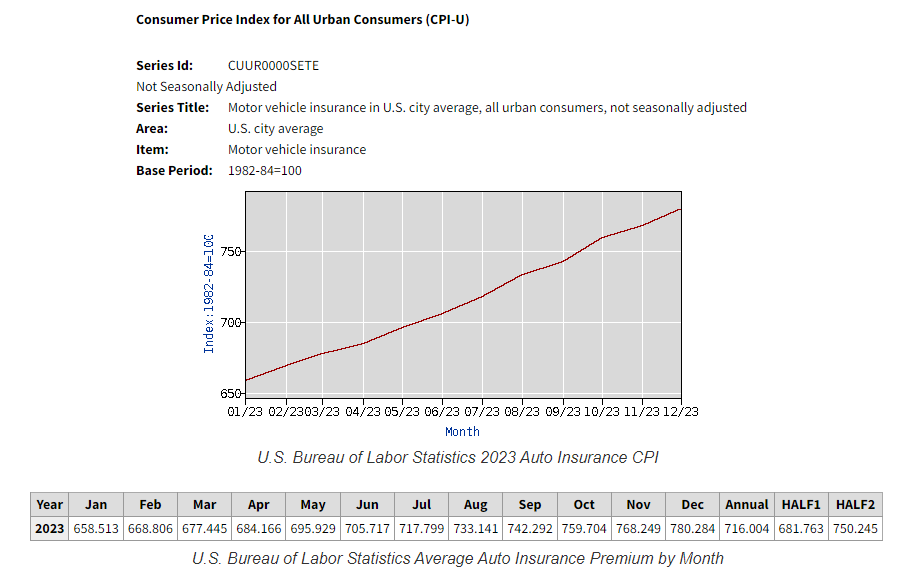

In 2023 the U.S. Bureau of Labor Statistics reported that the average annual auto insurance premium increased from $658.51 in January to $780.28 in December. The average annual auto insurance premium for all of 2023 was $716.00, with the first half of 2023 coming in at $681.76, and the second half at $750.24.

How Have Modern Safety Features Changed the Car Insurance Landscape in Idaho?

Modern cars are packed with safety features that were non-existent in the 1980s. Airbags, ABS, electronic stability control (ESC), and lane departure warnings are just a few examples. While these features are undoubtedly positive for reducing injuries and fatalities, they also come with a price tag:

- Repair Complexity: Modern safety features often involve complex sensors and electronics. Repairing a car with these features after an accident can be more expensive than repairing a simpler car from the 1980s. This can translate to higher insurance costs for drivers.

- Replacement Costs: Safety features often add to the overall value of a car. A car with a suite of safety features might be more expensive to replace in the event of a total loss, which can also impact insurance premiums.

However, it’s important to remember the long-term benefits:

- Lower Claim Severity: Safety features can significantly reduce the severity of accidents, leading to lower medical costs and repair bills for insurance companies. Over time, this could potentially lead to stabilized or even reduced premiums for drivers with a history of safe driving and cars equipped with advanced safety features.

- Discounts for Safety Features: Many car insurance companies in Idaho offer discounts for vehicles equipped with specific safety features. This can help offset some of the potential cost increases associated with these features.

The impact of modern safety features on Idaho car insurance is a complex interplay between repair costs, replacement costs, potential claim reductions, and available discounts. By reviewing options and available discounts, Idaho motorists can find the cheapest auto insurance quotes, and save money on protecting their vehicle and their financial well being.