Here are CheapInsurance.com’s top picks for the cheapest car insurance in California

Car insurance in California is required by law and all drivers need to have at least the minimum amount of insurance required in order to legally operate their vehicles in the state.

For full coverage car insurance, you can expect to pay about $1,967 per year in California. Minimum car insurance coverage will cost you an average of $624 annually.

However, with so many options to select from, it can be difficult to know where to begin when looking for the best inexpensive car insurance. That’s why it’s important to look for prices offered by different auto insurance companies.

Cheapest Minimum Liability Car Insurance in California

Minimum liability insurance is the cheapest option you can buy in California. While these plans are affordable insurance, you should make sure that they offer enough coverage in the event of an accident.

The average cost of minimum liability auto insurance in California is $175.89 per month.

| Monthly Price in | ||||||

| Provider | Average Monthly Price | Los Angeles County | San Diego County | Orange County | Riverside County | San Bernardino |

| GEICO | $49 | $45 | $54 | $56 | $44.87 | $44 |

| 21st Century | $133 | $150 | $123 | $121 | $138 | $131 |

| Esurance | $136.71 | $171.10 | $122.12 | $124.45 | $133.45 | $132.45 |

| MileAuto | $146 | $186 | $128 | $129 | $138 | $147 |

| AAA | $123.45 | $146.83 | $122.83 | $106.91 | $116.66 | $124 |

Key Point: Can You Drive Someone Else’s Car Without Insurance in California?

You don’t need nonowner car insurance in California to drive someone else’s car occasionally. Their insurance plan will generally include some coverage for other drivers.

However, if you don’t own a car and frequently borrow other people’s vehicles, you may want a nonowner auto policy to provide a comfortable level of liability coverage.

Cheap Full Coverage Car Insurance in California

In California, full coverage insurance is more expensive than liability car insurance, but it offers more protection and larger coverage limits.

Comprehensive and collision insurance are included in a full coverage policy, which protects drivers from both road accidents and off-road occurrences.

The most affordable full coverage car insurance in California is through GEICO, with an average monthly premium of $113. We also recommend looking at the policies offered by 21st Century and Esurance, because their average monthly rates are $153 and $180 respectively.

| Monthly Price in | ||||||

| Provider | Average Monthly Price | Los Angeles County | San Diego County | Orange County | Riverside County | San Bernardino |

| GEICO | $113 | $95 | $107 | $106 | $133 | $125 |

| 21st Century | $153 | $174 | $141 | $139 | $158 | $151 |

| Esurance | $179.90 | $230.15 | $152.51 | $155.18 | $178.33 | $183.33 |

| AAA | $186.13 | $229.25 | $182.66 | $157.50 | $173.50 | $187.75 |

| Dairyland | $291 | $416 | $222 | $310 | $253 | $253 |

Cheapest Auto Insurance for Good Drivers (Clean Driving Record) in California

If you haven’t had traffic offenses on your record, like a speeding ticket, DUI, or automobile accident, in the last five years, you’ll likely be able to receive some of the best and cheapest auto insurance in California.

For California drivers with clean driving records, GEICO offers the cheapest car insurance, with an average monthly premium of $103.

| Monthly Price in | ||||||

| Provider | Average Monthly Price | Los Angeles County | San Diego County | Orange County | Riverside County | San Bernardino |

| GEICO | $103 | $95 | $107 | $110 | $105 | $99 |

| 21st Century | $142 | $161 | $131 | $130 | $147 | $140 |

| MileAuto | $159 | $202 | $141 | $143 | $152 | $159 |

| AAA | $162.68 | $207.83 | $158.75 | $136.75 | $149.75 | $160.33 |

| Kemper Auto | $201 | $242 | $205 | $188 | $190 | $182 |

Cheapest Car Insurance for Bad Drivers (DUI, Traffic Ticket) in California

GEICO has the cheapest car insurance rates in California for drivers with DUI violations or traffic fines. We also recommend obtaining car insurance quotes from Kemper Auto, which is the second most cost-effective option for “bad drivers.”

Because drivers with traffic violations are regarded as riskier to insure, their auto insurance rates are higher.

The cheapest average monthly car insurance premiums for full coverage car insurance in California is $103; however, if you are a “bad driver” it will cost you around $165. That is more than $60 extra per month for the same insurance coverage.

| Monthly Price in | ||||||

| Provider | Average Monthly Price | Los Angeles County | San Diego County | Orange County | Riverside County | San Bernardino |

| GEICO | $165 | $200 | $142.70 | $160 | $180 | $140 |

| Kemper Auto | $405 | $540 | $410 | $446 | $360 | $271 |

| Bristol West | $481 | $715 | $372 | $457 | $398 | $465 |

| National General | $506 | $701 | $570 | $368 | $431 | $461 |

| Dairyland | $634 | $885 | $484 | $672 | $565 | $565 |

Affordable Car Insurance for Young Drivers in California

AAA has the most affordable car insurance rates in California in both full and minimum coverage for teen drivers. We also recommend obtaining auto insurance quotes from MileAuto, which is the second most cost-effective option for full or basic insurance coverage.

Because young drivers are more likely to be involved in automobile accidents, they are regarded as a higher risk for insurance companies. As a result, teen drivers’ car insurance rates are generally higher than adults.

Anyone between the ages of 15 and 25 is classified as a young driver. However, your insurance will be cheaper when you are 25.

Here are some of the cheapest car insurance options for young drivers in California:

| Monthly Price in | ||||||

| Provider | Average Monthly Price | Los Angeles County | San Diego County | Orange County | Riverside County | San Bernardino |

| AAA | $139 | $120 | $150.20 | $140.75 | $135 | $146.75 |

| MileAuto | $238 | $309 | $207 | $211 | $224 | $238 |

| Esurance | $287.92 | $388.84 | $238 | $245.74 | $285.89 | $280.72 |

| Kemper Auto | $353 | $475 | $302 | $336 | $311 | $340 |

| GEICO | $478 | $520 | $470 | $510 | $430 | $460 |

Find Inexpensive Car Insurance in Other States

If you’re looking for the cheapest car insurance quotes in other states, read our insurance state guides to find the best inexpensive car insurance or use our online quote finder.

Texas

Florida

New York

Cheapest Automobile Insurance Companies in California

1. Kemper Auto

Kemper is an American insurance provider with over $14 billion in assets, roughly 10,000 employees, and annual revenue of $5.2 billion.

They are best known for providing cheap auto insurance coverage for high-risk drivers, but the car insurance company also offers an array of other insurance, including:

- Homeowners insurance.

- Life insurance.

- Supplemental health insurance.

The Kemper headquarters is located in Chicago, Illinois, but they also have 34 offices located around the U.S.

Better Business Bureau (BBB) rating: A+

2. 21st Century

21st Century Insurance was founded in 1958 and is a subsidiary of Farmers Insurance. The company now exclusively sells auto insurance in California.

This car insurance company does the majority of its business online and over the phone. 21st Century is best suited to those who don’t mind not having a personal agent.

Some of the pros of 21st Century are their complimentary roadside assistance and ability to file SR-22 forms.

Better Business Bureau (BBB) rating: A+

3. Mile Auto

The American insurance provider, Mile Auto, is a newcomer to the game, being founded in 2017. It is known for its pay-per-mile auto insurance programs, where they only charge you for the miles you drive.

In 2021, Mile Auto acquired $10.3 million in SEED funding, which they are using to:

- Expand their availability to half of the U.S.

- Hire more employees.

- Add new distribution channels.

- Onboard white-label partners.

- Expanding its automaker network.

The Mile Auto headquarters are located in Atlanta, Georgia, but they are also available in California, Arizona, Georgia, Illinois, and Oregon.

Better Business Bureau (BBB) rating: A+

4. Dairyland

Dairyland was formed in 1953 and has its headquarters in Wisconsin. The company specializes in coverage for high-risk drivers with bad driving histories, no past insurance, or little driving experience.

Dairyland offers standard auto insurance discounts, for things such as:

- Possessing an anti-theft device.

- Defensive driving certification.

- Homeowners’ or renters’ insurance.

- Bundling numerous vehicles under one policy.

Better Business Bureau (BBB) rating: A+

5. Bristol West

Bristol West is a member of the Farmers Insurance Group of Companies, one of the nation’s largest insurer groups that offer a wide variety of insurance options, including auto insurance.

They are best known for offering coverage for high-risk drivers and can especially help you out with an SR-22 — a certificate required for some drivers by their state or court order.

The Bristol West headquarters are located in Davie, Florida, but they also have agents and brokers in 43 states across the country.

Better Business Bureau (BBB) rating: A+

Average Car Insurance Costs in Different Parts of California

Car insurance providers calculate your rate depending on a variety of factors, one of which is the vehicle’s location.

Here are the average annual prices for car insurance within some of the largest California cities:

| City | Annual Price |

| Los Angeles | $2,838 |

| San Diego | $1,898 |

| San Jose | $2,020 |

| San Francisco | $2,441 |

| Fresno | $2,006 |

| Sacramento | $2,236 |

| Long Beach | $2,245 |

| Bakersfield | $1,984 |

| Oakland | $2,380 |

| Anaheim | $2,136 |

| Average | $2,218 |

Tips for Choosing Car Insurance in California

Minimum auto insurance requirements: A minimum amount of liability insurance coverage is required by law for California drivers. This includes minimum coverage for bodily injury liability and property damage liability.

Uninsured motorist bodily injury and property damage coverage must also be offered to you by your insurer, but you can decline in writing if you do not wish to have them provided.

Lender requirements: If you’re financing or leasing your car, you’ll likely have to get auto insurance coverage to meet the needs of your lender.

For example, many lenders require you to get collision and comprehensive insurance if your car is leased or loaned. Auto insurance policies like these are referred to as “full coverage” policies.

Individual needs: There is no one-size-fits-all approach to auto insurance. Some people might live in areas where traffic and tourism are intense (such as Los Angeles or San Francisco), others might have a bad driving record, or insure a young driver.

Depending on your specific requirements, having collision and comprehensive coverage, uninsured motorist coverage, or towing and rental reimbursement might be a good idea.

California Car Insurance FAQs

Am I required to carry car insurance in the state of California?

Yes, California requires drivers to carry at least the minimum auto insurance coverages. If you do not have auto liability insurance:

- You can be fined.

- Your license may be suspended.

- Your vehicle could be impounded.

Which company has the cheapest car insurance in California?

We found that AAA offers the lowest quotes for minimum coverage car insurance in California. They charge an average of $123.45 monthly for minimum coverage. The cheapest full coverage car insurance is 21st Century with $152.60 per month.

How much does car insurance cost in California?

On average, minimum-coverage car insurance in California costs $604 per year, or $50 per month, while full coverage costs around $179 per month or $2,148 per year.

What is the best car insurance in California?

Knowing what you are looking for — the lowest price, stellar customer service, a digital app, or special coverage — might help you identify which California car insurance companies can fit your needs and are the best for you. You can then get insurance quotes from several of these car insurance companies to see which is the best fit.

How Much Car Insurance Do I Need in California?

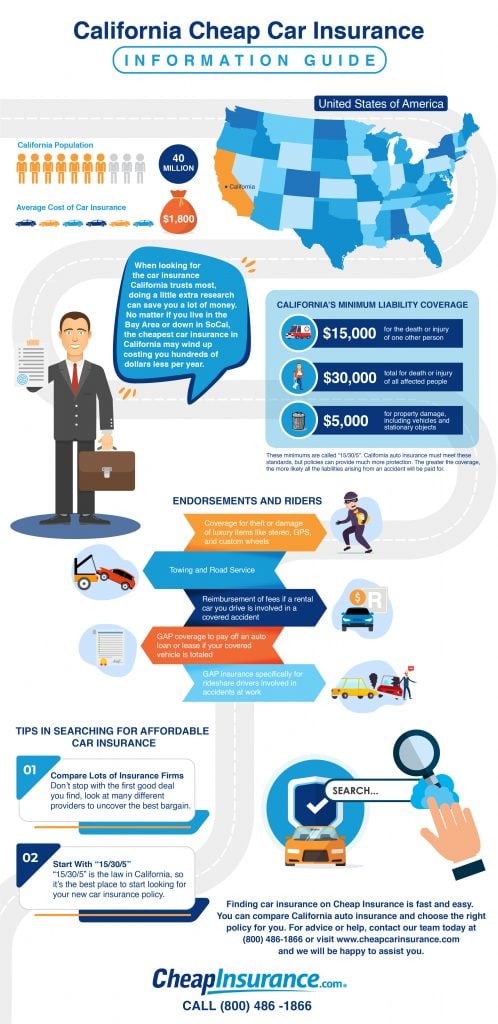

California requires both liability insurance and uninsured motorist liability insurance. The minimum level of auto coverage required by state law is:

- Bodily injury liability insurance: $15,000 per person, $30,000 per accident.

- Property damage liability coverage: $5,000.

- Uninsured motorist bodily injury coverage: $15,000 per person, $30,000 per accident.

Disclaimer:

Cheap Insurance strives to keep all listed information accurate and up-to-date. The information we provide shouldn’t be considered as the price or amount you will pay for any form of insurance provided by the auto insurance companies discussed on the CheapInsurance.com website. All information displayed on this website is presented without warranty and is non-binding. Visitors to the CheapInsurance.com website should contact CheapInsurance.com, their insurance broker, or their financial provider for final pricing, offers, and quotes.

Methodology:

Our researchers sourced insurance quotes from auto insurance companies that operate in the regions we investigated. We used a standardized base profile for each section to compare auto insurance offers. For the following sections:

- Minimum Liability Car Insurance

- Cheapest Full Coverage Insurance

- Cheapest Car Insurance for Good Drivers (Clean Driving Records)

- Cheap auto insurance for bad drivers

Base profile used: Gender: Male Marital Status: Married Age: 32 Vehicle: The most popular sedan by sales in the state Vehicle Year: 2017 Model Type: The most basic type/entry-level model. Mileage: 12000 miles

- Cheapest Car Insurance for Young Drivers

Base profile used: Marital Status: Single Age: 20 Gender: Male Vehicle: Drives the most popular sedan by sales in the state Vehicle Year: 2017 Model Type: The most basic type/entry-level model. Mileage: 12000 miles

California Car Insurance Discounts

Make your cheap car insurance even more affordable with a couple of discounts available for California drivers. Request a car insurance quote with Cheap Insurance to see if you qualify for them.

Good Driver Discount

- A valid license holder for at least three years

- Licensed in the US or Canada in the past 18 months

- Without more than one point received from the DMV in the last three years

- Without offenses or felonies related to driving in the past 10 years

Good Student Discount

- Have 8 years or less of driving experience.

- Be currently enrolled full-time in high school, college, university, or homeschooling.

- Maintain an average of B, 3.0 GPA, top 20% in SATs, or other academic equivalents.

Other Available Insurance Discounts

Though it depends on what the insurance company offers, other California car insurance discounts you could qualify for include:

- Multi-car coverage. This is for drivers who will insure more than one vehicle with the same insurer.

- Defensive driver/mature driver discount. Drivers over 50 years old can get a small discount by finishing a certified defensive driving course.

- Multiple Policy. You can be eligible for this by purchasing other insurance policies besides your auto insurance policy.

FAQs

What Is the Penalty for Driving without Insurance in California?

Driving without insurance is against the law in California. You can’t register a vehicle with the Department of Motor Vehicles unless you have current insurance. If you’re found driving without insurance, you can be fined. You may also have points assessed against your license or have your vehicle impounded.

What Is Driving Like in California?

Driving in California is quite similar to driving in other states: fewer cars in smaller cities, more cars in bigger cities. Urban centers like Los Angeles are notorious for their traffic jams.

California has a large motorist population, with over 27 million licensed drivers. With many people driving, you can expect a high number of dangerous accidents. The state had around 3,700 crash-related fatalities just last year. More than 16 percent of California drivers are also uninsured, which means you can’t file an insurance claim against them if they injure you in an accident.

How Can I Save Money on My Car Insurance Policy in California?

- If you have two or more cars, ask the insurer if they offer multi-car discounts.

- You can also inquire about the mature driver and good driver discounts if you’re over 50 years old or have a spotless driving record.

- You could raise deductibles on your policy to get lower car insurance premium.

- Some insurance companies may offer low mileage discounts. You can consider this if you only drive short distances.

Other Types of Coverage

The required basic liability insurance may not be enough to cover you in case of accidents. Here are a few more coverages you might want to add to your policy:

Uninsured Motorist Coverage (UMC)/Underinsured Motorist Coverage (UIM)

When faced with an at-fault driver that isn’t insured or doesn’t have enough coverage, UMC/UIM will help cover the expenses they were supposed to pay you. However, you can’t collect more than your policy’s limits.

Medical Payments Coverage

This coverage comes into play when you or your passengers are injured in a crash. It will help pay for medical expenses like hospitalizations, surgeries, and medical tests regardless of fault.

Physical Damage Coverage

- Collision: Besides damage from another car, it also covers crashes with other objects, such as trees or utility poles.

- Comprehensive: This covers expenses for damage not caused by collisions, such as fires or robberies.

Endorsements and Riders

- Coverage for theft or damage of luxury items like stereo, GPS, and custom wheels

- Towing and road service

- Reimbursement of fees if a rental car you drive is involved in a covered accident

- GAP coverage to pay off an auto loan or lease if your covered vehicle is totaled

- GAP insurance specifically for rideshare drivers involved in accidents at work